Price Action 1 2 3 method in the Market

The Price Action 1-2-3 method helps traders assess potential forex price setups on charts that might prompt a breakout in a specific direction. This approach aids in analyzing and predicting the likely path that a price breakout will take.

Price action trading is a technique utilized by forex traders to assess how prices change on forex charts by solely using price action study.

What Is the Price Action Forex Trading Method? - Price action means only using price charts to trade currencies, without using any technical indicators. When you trade using this price action method, you use candlestick charts. This trading strategy uses lines and set price patterns like the 1-2-3 price pattern that either appears or a series of candle bars.

This particular market analysis methodology is favored by traders because it is highly objective, allowing the professional to assess forex market fluctuations solely based on their visual interpretation of the currency charts and the movement analysis presented.

Many traders use this strategy. Even those who trade with forex indicators often blend in some price action for their setups.

The best use of this price action forex method is achieved when the signals generated are combined with line tools so as to provide extra confirmation. These line tools include forex trend lines, Fib retracement zones, support & resistance zones.

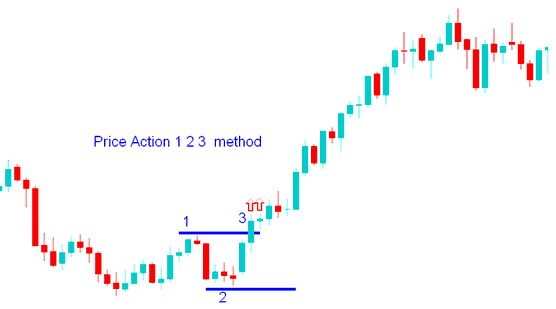

Price Action 1-2-3 Breakout - The Forex Price Action 1.2.3 Trading Method

The 1-2-3 price action setup uses three points on a forex chart to spot breakouts. Point 1 is a peak, point 2 a trough. Break above the peak signals a buy. Break below the trough signals a sell. The breakout creates point 3.

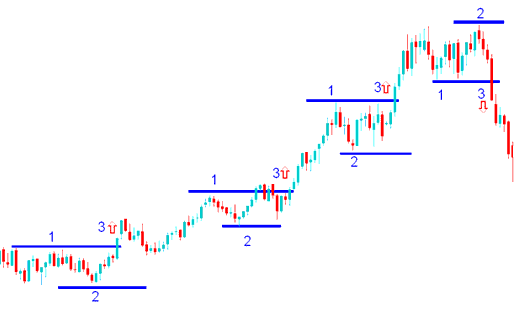

Price Action 1-2-3 Breakout Forex Trade Strategy - Trading Forex Price Action 1.2.3 Method

Series of break outs in 1-2-3 price action strategy

Price Action Breakout Forex Strategy: The 1-2-3 method outlines a sequence of breakout scenarios for effective trading setups.

Investors use a strategy based on price changes to try and guess which way a currency's price will move. The market is either going in a direction or staying in a range.

A trending forex market goes in a clear direction, while a ranging market goes back and forth, usually after reaching a support or resistance level.

Price action tells if the market trends, stays in range, or turns around.

Like any Forex plan, this one should also be used with other Forex tools to avoid false signals. The 1-2-3 price action can give good Forex signals when the market is going in a direction, but it will give false signals when the market is staying in one place: you should find out if the market is going in a direction before you start using this plan.

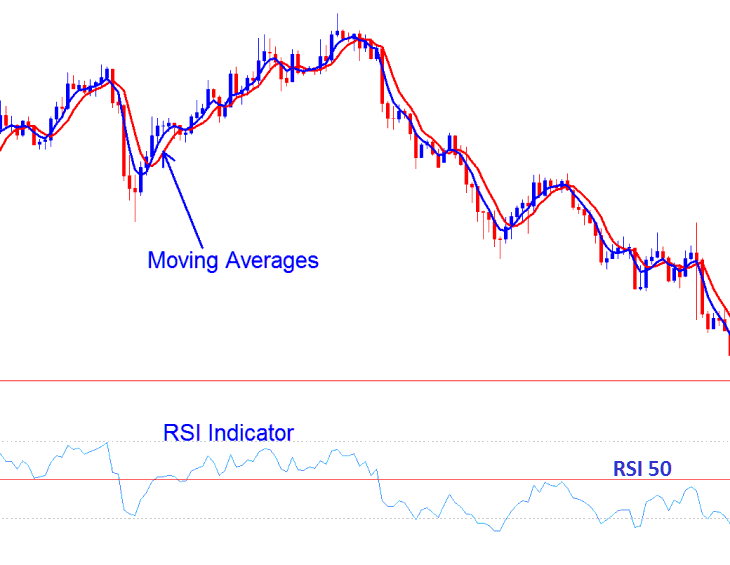

Integrating the 1-2-3 Price Action Forex Strategy with Additional Indicators.

Good forex indicators to combine forex price action method with are:

- RSI Indicator

- Moving Average Indicator

Investors and forex indicators should use these two indicators to confirm if the direction of price action breakout is in line with the trend direction shown by these 2 technical indicators. If the direction of the price action breakout is also the same as that of these indicators then investors & traders can open a trade transaction in the direction of the signal. If not investors and traders should not open a trade as there is more likely a chance that this signal may be a whipsaw.

Just like any other indicator in Forex, price action also has whipsaws & there is a requirement to use this as a combination with other signals as compared to just using this strategy alone.

Integrating the 1-2-3 Price Action Forex Strategy with Supplementary Indicators - RSI and Moving Average Combinations

More Topics and Tutorials:

- Strategy Guidelines for Trading the SWI 20 Index in Forex

- How Can I Add SMI in MetaTrader 4 SMI Phone Trade App?

- How to Use MetaTrader 5 Ehlers Fisher Transform Indicator

- Procedure for Setting a Stop Loss BTC USD Order via the MT5 iPhone Trading Application

- How Do I Identify FX Breakout Pattern?

- How Can I Trade DJI 30 Index Trading Systems Lesson?

- USD SEK Trading Spread

- Place Fractals Indicator on XAUUSD Charts in MT4

- Forex True Strength Index (TSI) Analysis

- Trading Strategy for the SPAIN35 Index