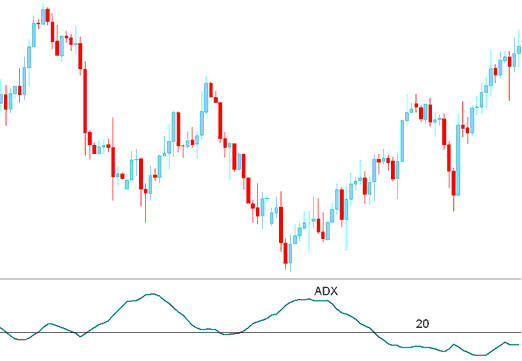

ADX Gold Technical Analysis & ADX Signals

Developed by J. Welles Wilder

This a momentum indicator used to determine the strength of a trading price trend: it's derived from the DMI - Directional Movement Index which has 2 lines.

+DI - Positive Directional Movement Index

–DI - Negative Directional Movement Index

ADX is calculated by subtracting these 2 values and applying a smoothing function.

The ADX is not a directional indicator but a measure of the strength of the xauusd trend which has a scale of Zero to 100.

Higher the technical indicator value the stronger the trend.

A value of below 20 indicates that the xauusd market isn't trending but heading in a range.

A value of above 20 confirms a buy or sell signal & indicates a new trend is emerging.

Values above 30 indicates a strong trending market.

When ADX indicator turns down from above 30, it demonstrates that the current xauusd trend is losing momentum.

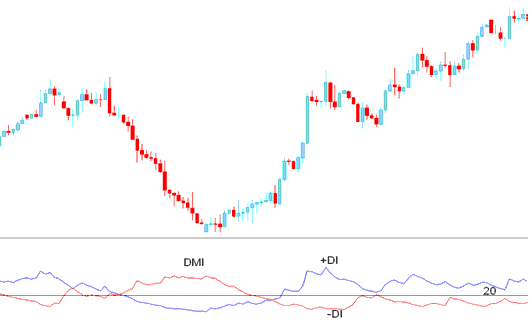

ADX combined with DMI Indicator

Since the ADX alone is a directionless indicator it is combined with the DMI index to determine the direction of the xauusd.

DMI

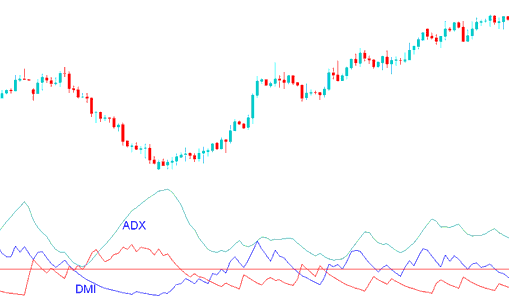

ADX & DMI Index

When the ADX is combined with DMI index a trader can determine the direction of the trend and then use the this indicator to determine the momentum of the prevailing xauusd trend direction.

Technical Analysis & How to Generate Trade Signals

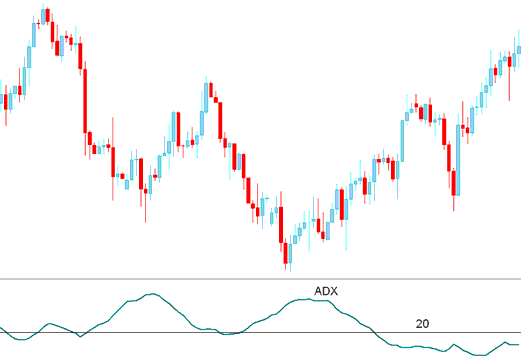

Buy Signal

A buy signal gets generated when the +DI is above –DI, and the ADX indicator is above 20

The Exit signal is generated when the indicator turns down from above 30.

Buy Gold Signal

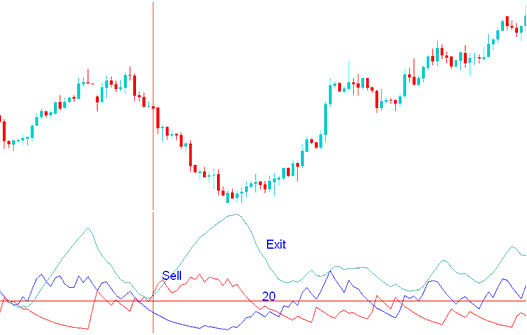

Sell XAUUSD Signal

A short signal is generated when –DI is above +DI, & the ADX indicator is above 20

The Exit signal is generated when the indicator turns down from above 30.

Sell Signal