How to Create Signals Using XAUUSD Systems - Generating Free Signals

The singular focus for XAUUSD trading should be upon signals. It is strongly recommended that traders develop the capability to generate these trading signals independently, thus removing reliance on external sources for this critical information.

Making signals is hard and requires a lot of knowledge and experience in gold technical analysis trading. But, the sooner you start trying to make these trading signals yourself, the more it will help you in the long run.

A good way to practice trade signals with systems is to open a free demo account for XAUUSD. You can test signals there without risking money. After checking strategies and seeing profits on the demo, move them to a live account.

Below is an explanation of the approach for practicing signal generation and backtesting these signals on a demo gold account using the MT4 platform.

So, How Can One Create Signals?

The best way to create trade signals is by using xauusd systems. You can learn how to create gold systems by looking at the guide on making systems found in the learn XAUUSD Key Concepts section.

A gold system includes one or more indicators. It has rules on how they create signals.

For instance, think about the easiest xauusd/gold system, also known as the MA crossover way. A signal to buy or sell is made when two moving averages cross over each other: a buy signal for when the MA goes up or a sell signal for when the trend goes down.

How Can I Generate Signals Using a Practice Account for Gold MT4 Free Signals?

Generating Gold Trading Free Signals - XAUUSD Buy & Sell Signals Generating

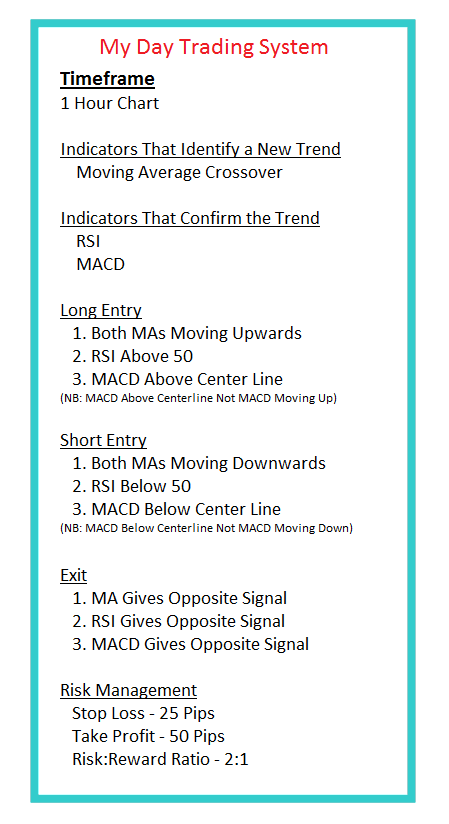

A simple gold trading system works well. It blends these basic parts together.

Moving average cross-over trading strategy method

RSI

MACD

The established XAUUSD rules are:

Generating Signals Strategy - System Examples - How to Generate Trade Signal to Trade Charts With

Generating Signals Strategy - System Examples

Trade Rules:

A Buy Trading Signal is produced when:

- Both Moving averages are trending upward

- RSI is above 50

- MACD is above the centerline

A Sell Signal is produced when:

- Both MAs are trending downward

- RSI is below 50

- MACD is below the centerline

Example of an XAUUSD Strategy Method

Generating Buy & Sell Trades - Explanation Examples of an XAUUSD Strategy Method

Exit Signal

The exit comes when moving average, RSI, and MACD all point against the current trend.

The suggested time frames for charts are either the H1 chart or the 15-minute chart frame, depending on the trading approach of the individual.

New traders can trust these XAUUSD rules for solid buy and sell tips. Gold traders must build the habit of following signals exactly. Wait for the strategy to flash a trade sign, then act only on it.

Back Testing

Generating signals with an XAUUSD system is one of the simplest methods to trade. It is the optimal approach for a beginner trader to ascertain the direction of the XAUUSD market trend with a reasonable degree of accuracy. Additionally, conducting some back testing on a demo practice trading account will help to continuously enhance the efficiency of this XAUUSD signals strategy.

The best way to backtest a trading strategy is by following these two steps:

- Gold Paper Trade

- Practice Demo Trade

Gold Paper Trading involves testing an XAUUSD trading system by applying it to a trading chart, then manually resetting the chart to a specific historical date, perhaps three months earlier. Using this archived chart data, the trader meticulously records where their strategy generated buy, sell, and exit signals for XAUUSD. Each of these points, along with the realized profit from the transaction, is documented on paper. After recording a statistically significant number of trades, say 50 paper positions, the cumulative profit is calculated. This process helps validate whether the XAUUSD technique is profitable overall, providing key statistics such as the win rate, loss rate, and the resulting risk-to-reward ratio.

This represents a time-honored technique for validating trading systems, utilized by conventional traders long before the emergence of online platforms or modern computing. These earlier traders relied on physical tools like A3 or A2 graph paper, manually rendering the trading charts (Consider the dedication required to physically sketch charts on your trading platform daily or hourly - would you undertake that task? Unlikely!). Those individuals were exceptionally diligent, and some became so proficient with this manual approach that they persist in paper trading within the modern online environment by drawing charts physically. Nevertheless, for the purpose of illustrating our paper trading methodology, a sample dataset consisting of 50 trade executions is sufficient for analysis.

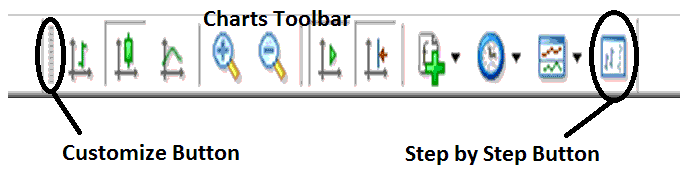

A valuable tool for back-testing your system is known as the MT4 Gold Step by Step Tool. This can be found in the MT4 charts toolbar of the MetaTrader 4 software. To locate the charts toolbar on MT4, it is situated at the top of the MT4 platform software. If it is not visible: Press View (located next to File, in the top left corner of MetaTrader 4) >>> Tool Bar >>> Charts. Then click the Customize button >>> Select XAUUSD Step by Step >>> Press Insert >>> Close.

MetaTrader 4 Software Chart Tool Bars - How to Trade for Beginner Traders

MT4 Chart ToolBars - XAUUSD Step by Step Button for Back Testing Systems Explained

Upon acquiring this specific MT4 utility, the trader gains the ability to invert their trading chart and use this MT4 tool for making step-by-step adjustments to the XAUUSD charts. Concurrently, you can backtest your system to determine when it would have signaled a buy or sell opportunity, and pinpoint where you would have exited those trades. Subsequently, meticulously record the resulting profit or loss for every executed trade. By analyzing a select portfolio of XAUUSD trades, you can then aggregate these figures to calculate the net profit or loss generated by your chosen trading methodology.

If your trading plan appears to make money when you practice trading, then it is good to try demo xauusd trading to see if it really makes money in the actual market, like it does on paper. This is like testing or checking how well a xauusd system works.

Writing a Journal

Keep a Gold Journal to track profitable trades and analyze the reasons behind their success. Additionally, maintain a record of all losing positions, identify the causes of these losses, and strive to avoid repeating the same mistakes in future trades using your trading strategy.

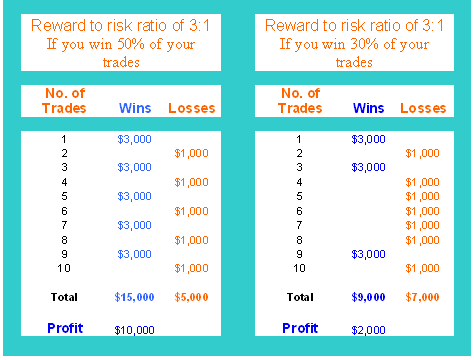

Make your gold system better until you get a good balance between the possible loss and gain with the trade signals it gives. Try to get a 3:1 balance between possible loss and gain and a success rate of over 70%, because that is seen as a good standard. With good money management, a trading plan can still make money even if it only wins 30% of the time - meaning most trades lose money. Looking at this lesson might help you understand what the table below means about the balance between possible loss and gain.

How Do I Use Balance of Power to Generate Signals?

Risk: Reward Ratio Chart of Money Management Strategy - XAUUSD Methods Explained

Read Gold Funds Management Methods and Strategies Lesson

A hands-on xauusd setup is still the best way to make signals when you look at it next to automatic setups: doing it yourself is better and simpler.

Some traders like using automated systems. If that's you, you'll find info about MQL5 Gold EAs and other automated systems on this page.

You are also encouraged to examine our extensive compilation of XAUUSD strategy topics, which feature various methodologies for buy and sell analysis employing a variety of distinct trading approaches. Kindly proceed to the Learn Strategies Section.

Learn More Lessons & Topics:

- How to Add Ehlers Fisher Transform Indicator on Trading Chart

- How to Add MetaTrader 4 Gann Swing Oscillator

- Analysis of Linear Regression Slope Gold Indicator

- Understanding How to Trade FX Carry System

- XAU/USD News Trading Strategies Guide

- Example SX5E Index Strategy

- Bollinger Bands Price Action in Upward Forex Trend and Downwards Trend

- Double Tops Setup Lesson Tutorial

- Educational Material for Developing US 100 Index Trading Systems (Downloadable)

- MT4 Draw XAU/USD Trend-line Trading Tools