Ichimoku Indicator

Ichimoku comes from Japan as a charting method. A newspaper writer and editor created it under the name Ichimoku Sanjin.

- Ichimoku means: "a glance" or "a look"

- Kinko meaning "equilibrium" or "balance"

- Hyo is a Japanese term for "chart"

Ichimoku actually means “a glance at an equilibrium chart.” It helps you spot where the market's headed and figure out the best times to jump in or get out.

Calculation

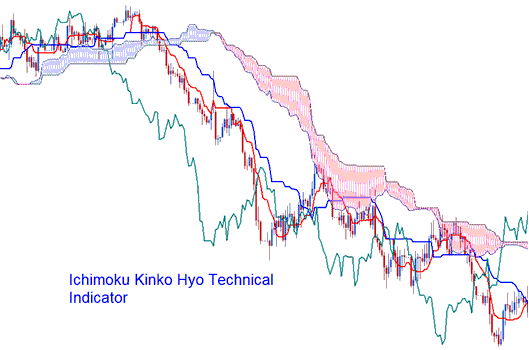

This indicator is composed of five lines that are drawn using the midpoints of prior highs and lows. The calculation of these five lines is performed as follows:

1) Tenkan Sen: Conversion Line: Red Line (Highest High + Lowest Low) / 2, based on the last 9 price bar periods.

2) Kijun-Sen: Representing the Base Line in Blue, calculated as the average of the Highest High and Lowest Low over the last 26 consecutive price intervals.

3) Chikou Span: Lagging Span: Represented by a green line indicating today's closing price plotted 26 price periods back.

4) Senkou Span A: Leading Span A = (Tenkan Sen + Kijun Sen) / 2, drawn/plotted 26 price periods ahead

5) Senkou Span B: Leading Span-B: (Highest High + Lowest Low) /2, from the last 52 periods, plotted 26 bars forward

Kumo: Cloud: area between Senkou Span A and B

Gold Analysis and How to Generate Trading Signals

Bullish trading signal - Tenkan-Sen crosses the Kijun-Sen from below.

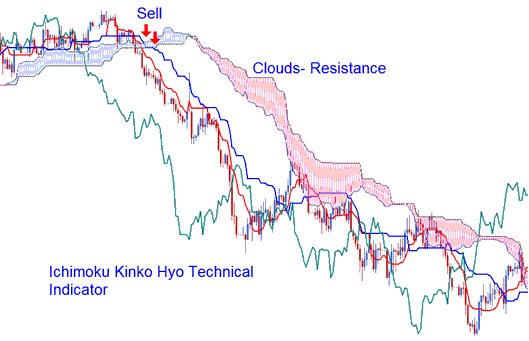

Bearish trading signal - Tenkan-Sen crosses the Kijun-Sen from above.

However, there are varying levels of strength for the buy and sell signals generated.

Analysis in Gold Trading

Bullish cross-over trading signal forms above the Kumo (clouds),

Strong buy signal.

Bearish cross-over trading signal forms below Kumo (clouds),

Strong sell signal.

A bullish or bearish cross-over in the Kumo clouds signals medium strength. It suggests a buy or sell.

A bullish cross over that happens beneath the clouds is seen as a poor buy sign, whereas a bearish cross over that happens above the clouds is seen as a weak sell signal.

Support & Resistance Areas

Support and resistance levels can be anticipated through the presence of Kumo (clouds). Kumo can also assist in identifying and recognizing the current market trend.

- If the price is above Kumo, the ruling trend is said to be upwards.

- If the price is below the Kumo, the ruling trend is said to be downwards.

Chikou Span or Lagging Span is also used to degree the momentum of the purchase/sell alternate sign.

- If the Chikou Span indicator is below the closing price of the last 26 periods ago and a sell short signal is given/generated, then the strength of the trend is downwards, otherwise the signal is considered to be a weak sell trade signal.

- If there is a bullish signal and the Chikou Span is above the price of the last 26 periods ago, then the strength of the trend is to the upside, otherwise it is considered to be a weak buy signal.

More Topics: