Spinning Tops Candlesticks Pattern & Dojis Candle Patterns

Spinning Top Candle Patterns

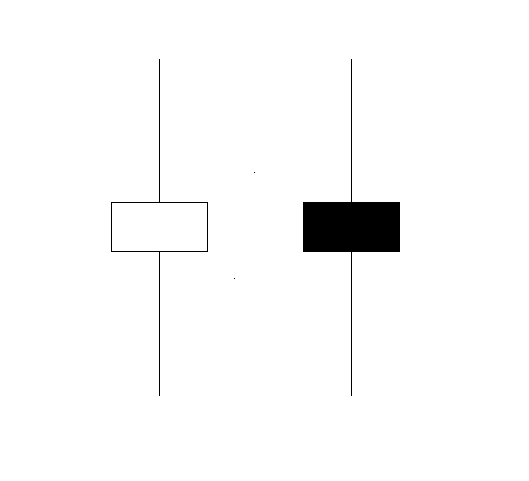

Spinning top candles exhibit a small central body flanked by long upper and lower shadows. They are named 'spinning tops' due to their visual resemblance to the top of a matchstick used for spinning.

The upper & lower shadows of the spinning top are longer than the body. The example illustrated & shown below shows spinning tops pattern. You can look for the pattern on your MT4 charts. Example shown below shows a screen-shot to help online traders when it comes to learning and understanding these formations.

How to study candlestick charts - Spinning Tops

Color of the spinning top candle-stick is not very important, this formation show the indecision between the buyers & sellers(bears) in the trading market. When these patterns appear at the top of a trend or at the bottom of the trend it may signify that the trend is coming to an end & it may soon reverse & start moving the in the opposite direction. However, it is best to wait for confirmation signal that direction of the market has turned & reversed before trading the signal from this chart setup formation.

Candle Reversal Patterns Formations in xauusd Trading Charts

At the peak of an uptrend, a black or red spinning top signals a likely reversal. This holds more than a white or blue one.

At the end of a downward XAUUSD trend, a white or blue spinning top hints at reversal. It's stronger than black or red.

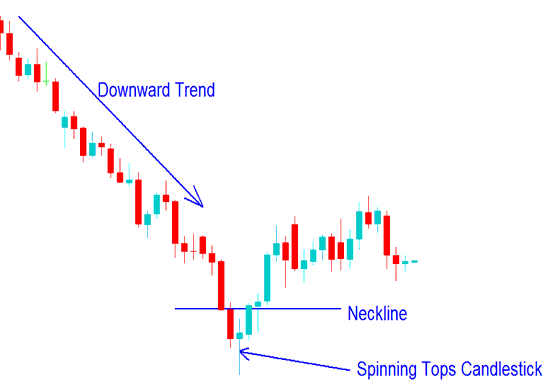

This signal is proven when the next candle that forms after the spinning tops candle closes below the neckline, showing a downward trend, & closes above the neckline, showing a reversal in a downward trend.

The neck-line is:

- For an Upwards XAUUSD Trend - The open of the previous candlestick that was formed just before the spinning top.

- For a Downward Trend - The open of the previous candlestick that was formed just before the spinning top candlestick

Illustrated below is a concrete instance utilizing Japanese charting methodologies where this specific pattern materialized, accompanied by instructions on how to trade it. In the chart provided, the moment the price surpassed the neckline, the reversal signal generated by the spinning top candle formation was validated, indicating an optimal juncture to close out a previously initiated short sell position.

Spinning Top Candle Pattern on a Chart

The spinning top is blue, so reversal odds rise. Red would mean less chance.

Doji Candles Pattern

This setup has the same open and close price. Doji patterns come in different types on charts.

The ensuing visuals demonstrate numerous variations in the Doji candlestick formation.

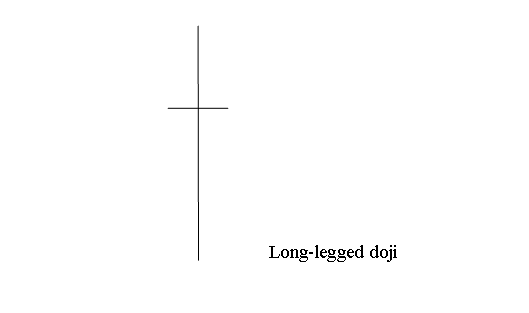

The long-legged doji candlestick features significant upper and lower shadows, with opening and closing prices positioned near the middle. When this pattern appears on a XAUUSD Gold chart, it signals indecision among traders, reflecting uncertainty between buyers and sellers.

Below is an example screenshot of Long Legged

- Doji chart pattern

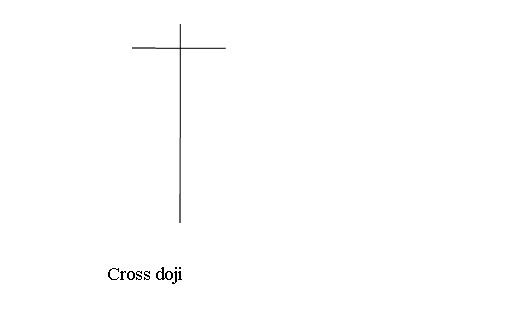

Cross Doji Candle

Cross doji has got a long lower shadow and a short upper shadow and the open and close-out of the day is the same.

This specific configuration materializes at shifts in market direction and functions as a precursor, signaling a potential reversal of the prevailing market trend. Illustrated below is a sample rendering of this chart pattern's formation.

- Cross Doji Candle Pattern

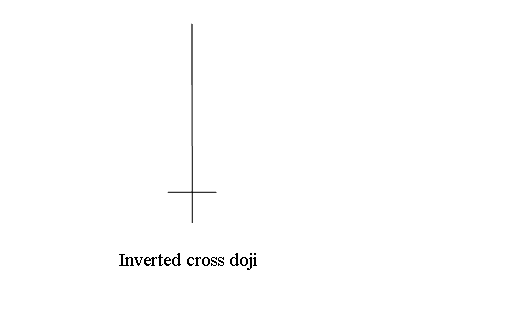

Inverted Cross Doji Candle Pattern

Inverted cross doji candles feature a long upper shadow and short lower one. Open and close prices match.

This pattern that shows a change happens at turning points and warns that the market trend might reverse. An example is shown in the picture below.

- Inverted Cross doji

When using Technical Analysis for XAUUSD Trading, doji candle patterns show when the market is unsure. This happens because buyers were strongest at the highest point, and sellers were strongest at the lowest point. However, neither group could take full control by the end of the trading period. The price at the end, shown by the candlestick, stayed the same as the starting price. This doji candlestick pattern shows that the total price change for that day was almost nothing or just a very small change of about 1 to 3 pips. To understand these chart patterns, the price difference between the start and end must be very small.

Learn More Topics and Courses:

- Steps to Put a Moving Average(MA) on Forex MT4 Charts

- Finding the SMI 20 Indicator in MetaTrader 5 on PC

- Drawing a Downward Trading Channel in MetaTrader 5 Online

- A List of Trading Tools on the Charts Section in MT4 Program

- Using the Parabolic SAR for forex chart analysis.

- Top FX Brokers for Beginners

- Bears Power MetaTrader 4 Tech Tool to Use

- Forex Trading Divergence: Techniques for Spotting and Capitalizing on Divergence Opportunities

- Developing Personal Trading Strategies for Forex Instruments