XAUUSD Retracement Trading

How Do You Use Trading Fibonacci in XAUUSD?

A good xauusd retracement strategy to use is the fibonacci retracement indicator. Fibonacci retracement indicator is used by many traders as a xauusd retracement strategy indicator tool.

The fibonacci retracement indicator is placed on a xauusd chart and this Fibonacci Retracement indicator then calculates the retracement levels on the gold charts.

Fib Retracement Strategy Examples on Upward XAUUSD Trend & Downwards Gold Trend

XAUUSD Retracement Strategy

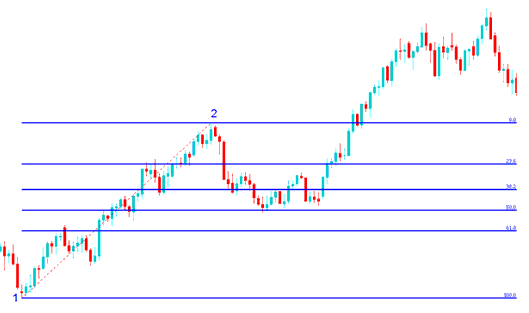

In the XAUUSD Retracement Strategy example shown below the gold price is moving up between chart point 1 & chart point 2 then after chart point 2 it retraces down to 50.0% retracement level then gold price continues moving up in original upward trend. Note that this retracement indicator is plotted from point 1 to point 2 in the direction of the trend (Upward Direction).

Because we know this is just a retracement based on our xauusd chart xauusd trend - using this retracement indicator, we put a buy order just between the levels 38.2% and 50.0% and our stoploss just below 61.8% pull back mark. If you had put buy at this point in the trade example shown below you would have made a lot of pips after the price retracement reached the Fibonacci 50.0% level and then continued moving in the original upward trend.

How to Trade Retracement on Upwards XAUUSD Trend - XAUUSD Retracement Strategy

Explanation for the Above Gold Retracement Strategy Example

Once the gold price hit the 50.0% retracement level, this retracement level provided a lot of support for the gold price, & afterwards xauusd market then resumed the original upward trend and continued to move upwards.

23.6% retracement level provides minimum support and is not an ideal place to place a gold trade order.

38.20% retracement level provides some support but gold price in this example continued to retrace upto the 50% zone.

50.0% retracement level provides a lot of support and in this example, this was the ideal place to set a buy gold trade order.

For this XAUUSD Retracement Strategy example, the gold price retracement reached the 50.0% retracement level, but most of the time the xauusd market will retrace up to 38.2% retracement level and therefore most of the time xauusd traders set their buy limit orders at the 38.2% Fibonacci retracement level, while at the same time placing a stop just below 61.8% Fibonacci retracement level.

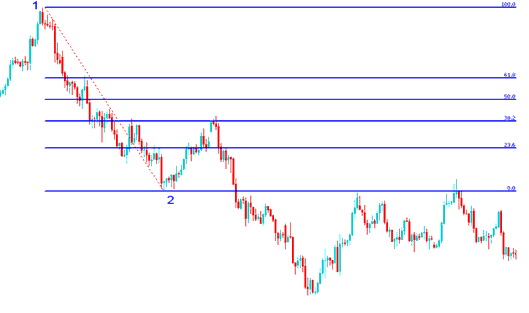

XAUUSD Retracement Strategy

In the XAUUSD Retracement Strategy example shown below the xauusd market is heading down between chart point 1 & chart point 2, then after chart point 2 the gold price then retraces up to 38.2% retracement level then it continues moving downwards in the original downward trend. Note that this retracement indicator is plotted from point 1 to point 2 in the direction of the trend (Downward Direction).

Because we know this is just a retracement based on the gold chart xauusd trend we put a sell order at 38.2% retracement level and a stop loss just above 61.8% retracement level.

If you had put sell order at the 38.2% retracement level as shown on the trade below you would have made a lot of pips afterwards after the price reached the 38.2% retracement level and then resumed the downward gold trend.

In this trade the retracement of gold price reached 38.20% retracement level and did not get to 50.00% retracement level. It is always good to use 38.2% retracement level because most times the gold price retracement doesn't always get to 50.00% retracement level.

How to Trade Retracement on Downward XAUUSD Trend - XAUUSD Retracement Strategy

Explanation for the Above Gold Retracement Strategy Example

The above XAUUSD Retracement Strategy examples is a xauusd retracement trading set up where the price retraces immediately after touching the 38.20% Fibonacci Retracement Level.

This XAUUSD Retracement level provided a lot of resistance for the gold price retracement, this was the best place for a trader to set a sell limit order as a xauusd market quickly moved down after hitting this retracement level.