Best Combination of Indicators - Stochastic Oscillator, Moving Averages, RSI & MACD Indicators

Best combination of indicators Guide - Stochastic Oscillator Technical Indicator, MAs, RSI & MACD

Stochastics Indicator Technical technical indicator can be combined with other indicators to make a Forex system - Buy Sell Signal Indicator MetaTrader 4 Indicators. For our examples we will combine it together with:

- RSI

- MACD

- MAs Moving Averages Indicator

Example 1:

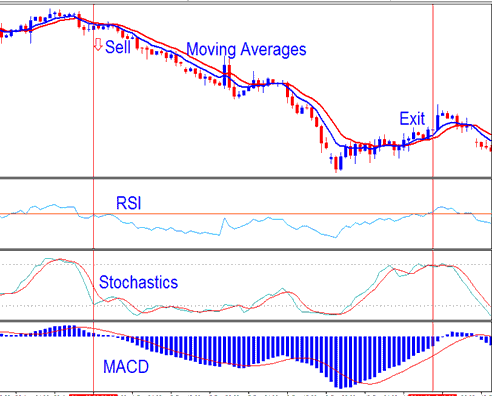

Sell Trade Signal - Best Combination of Indicators

From our trade system sell trade signal is derived/generated when:

- Both MAs Moving Averages are heading down

- RSI is below 50

- Stochastic heading and moving downwards

- MACD heading downwards below centerline

The sell signal was derived & generated when all these fx rules were met. The exit signal is generated/derived when a signal in the opposite direction is derived & generated i.e. When indicators reverse.

The good thing about using such a trading system is that we are using different types of indicators to confirm trade signals and avoid as many whip saws as possible in the process.

- Stochastic - is a momentum oscillator technical indicator

- RSI- is a momentum oscillator technical indicator

- MAs Forex Indicator- is a price trend following technical indicator

- MACD- is a price trend following technical indicator

It's very helpful to combine more than one fx technical indicator, as a combination of signals is better than relying on just one single forex indicator. The forex technical indicator combinations reinforce each other signal, and cancel out false whip saw fake out trading signals.

A trend following technical indicator helps a forex trader to see the overall picture, while using more than one momentum indicator gives better and more reliable entry and exit points for trading.

Best combination of indicators & their signals help to interpret a lot of market activity.

Example 2:

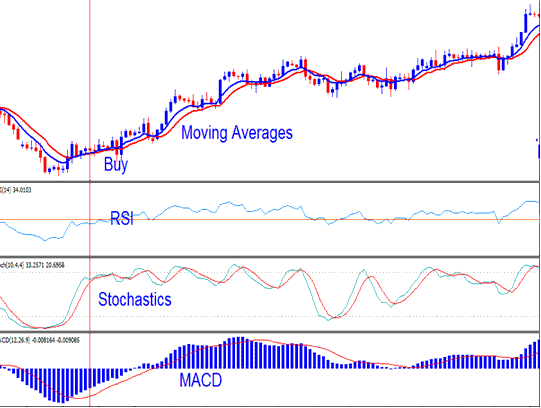

Buy Trading Signal - Best Combination of Indicators in FX Trading

For this example the forex trend is clearly upwards, but at some point there were a few whipsaw fakeouts generated by the stochastic oscillator technical indicator technical indicator, can you identify them? - So the question is how can one avoid trading these forex whipsaws?

Well, the answer is that by checking on the other technical indicators such as MACD a forex trader could have avoided the whip saw, even the MACD had not given a forex cross-over signal although it was very close to the zero centerline level, at the same time gradient/slope at which the moving averages(MAs) turned wasn't so sharp as to signal a decisive forex trend reversal. The thing is that it’s not so obvious when it comes to recognizing fake out whipsaws: it is a skill that takes some time to master but after some time you as a trader can spot whipsaw fake-outs after some practice.

One tip is that as long as MACD is above zero center line even if MACD lines are moving downwards then the trend is still upwards. As you as a trader can see from the above example MACD never went below zero line and afterwards the upwards trend continued with the MACD maintaining above Zero-line and continuing to move upward.

Duringranging sideways forex market trends Stochastic Oscillator will give the fastest signals which are prone to whipsaws. This is why stochastic oscillator is best combined together with other indicators & signals transacted are confirmed by other one or two other indicators to form - Best Combination of Indicators - Top 10 MT4 Indicators - Combination of Indicators for Forex Trading.

Learn More Topics & Courses:

- How to Get and Find NETH 25 on MT5 PC

- Indicators List on Charts Menu in MetaTrader 4 Platform

- Forex Lines Trade Trend-lines on Charts Explained

- Upper & Lower Limits of FX Bollinger Band Technical Indicator

- How Can I Calculate 100 Pips Profit for 1 Standard Lot?

- How Can I Use MT4 DeMark Range Projection Stock Indices Indicator?

- Buy Stop Order and Sell Stop Order

- Developing Stock Index Trade Strategy: Indicator Stock Index Trading Strategy for Stock Index