Best Divergence Indicator - Divergence Indicators

A comprehensive explanation of UsTec 100 indicators and their technical analysis applications, including strategies for trading the UsTec 100 using these indicators.

The 2 types of divergence - bullish & bearish divergence are illustrated below.

RSI Hidden Bullish and Bearish Divergence Trade Setups

Hidden divergence is often used by traders as an indicator of trend continuation. It typically occurs when prices retrace to test a previous high or low.

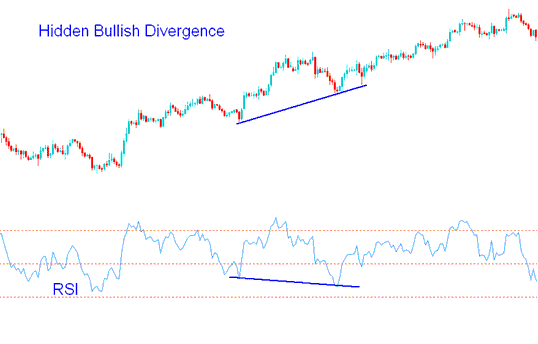

Hidden RSI Bullish Divergence Trading Setup

This occurs when the price creates a higher low (HL) while the oscillator indicator shows a lower low (LL), signaling divergence.

Hidden bullish divergence in forex occurs when there is a retracement in an uptrend.

Hidden Bullish Divergence - best divergence trading indicator

This shows that a pullback is done. This difference tells us there's strength in a price increase.

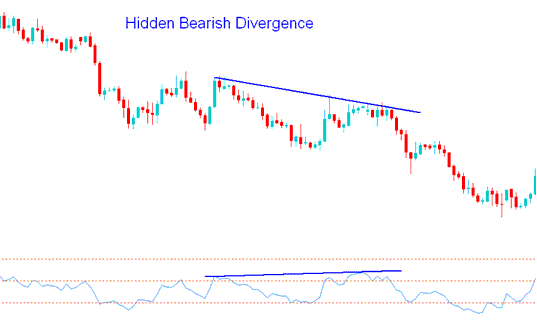

Hidden RSI Bearish Trading Divergence

This pattern occurs when the price is forming a lower high (LH) while the RSI shows a higher high (HH).

Hidden bearish divergence in forex occurs when there is a retracement in a downtrend.

Hidden Bearish Divergence - best divergence technical indicator

This divergence trade setup shows that a retracement move is ending. This divergence shows how strong a down-trend really is.

Learn More Lessons and Tutorials and Courses:

- MetaTrader AS51 Index – AS51 on MT5 FX software

- Determining Optimal XAUUSD Leverage for Newcomers to Gold Trading

- Hang Seng 50 on MT4: Identifying Hang Seng Name

- Automated EA Using Parabolic SAR

- Stochastic Analysis for Gold in XAUUSD

- Overview of Gold Market Session Overlaps and the Three Primary Trading Sessions

- How does the Bears Power indicator work in trading?

- Ways of Using MetaTrader 4 DeMarks Projected Range Indicator

- How to utilize Linear Regression in trading?

- How do you insert line studies in MetaTrader 4?