Bollinger Band Bulge & Squeeze Technical Analysis

The FX Bollinger Band are self adjusting which means the bands widen and narrow depending on forex price volatility.

Standard Deviation is how the market measures how much the price changes, and it's used to figure out if Bollinger bands are getting closer or further apart. Standard deviation is higher when prices change a lot and lower when prices don't change much.

- When forex price volatility is high the Bollinger Band widen.

- When forex price volatility is low the Bollinger Band narrows.

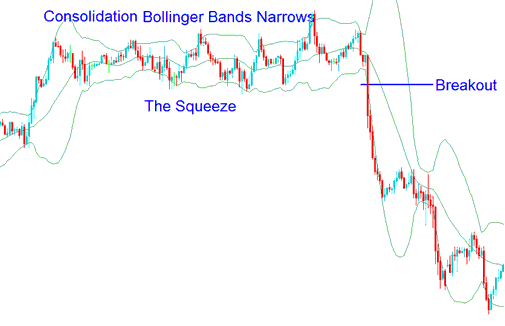

The Bollinger Band Squeeze Explained - How to Trade Using the Bollinger Band Squeeze

The narrowing of the Bollinger Band signals price consolidation, commonly referred to as the Bollinger band squeeze.

Narrow Bollinger Bands mean low standard deviation. Prices often consolidate then. This signals a breakout soon. Traders adjust positions for the next big move. The longer prices stay tight, the stronger the breakout chance.

The Bollinger Band Squeeze Explained - How to Trade Using the Bollinger Band Squeeze

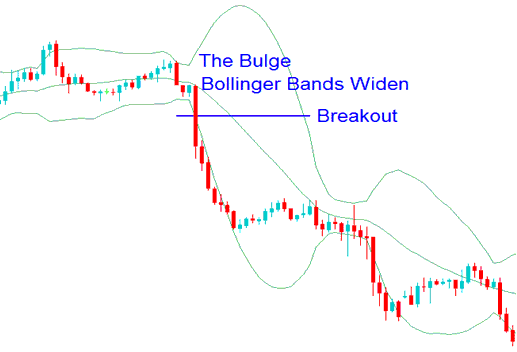

The Bollinger Bulge - How to Trade Bollinger Band Bulge

When Bollinger Bands expand significantly, it signals an impending price breakout, a phenomenon termed the Bollinger Bands Bulge.

Bollinger Band that are far apart can serve as a trade signal that a market trend reversal is approaching. In the Bollinger bands indicator example below, the Bollinger bands get very wide as a result of high forex price volatility on the down swing. The forex trend reverses as prices reach and get to an extreme level according to statistics and the theory of normal distribution. The "bulge" predicts the change to a downtrend.

Bollinger Bulge - The Bollinger Bulge - How to Trade When the Bollinger Band Bulges

More Instructions and Educations:

- Using Bulls Power Automated Forex Trading Robot System

- Top ECN Brokers Ranked for Traders

- Price Action Price Action Trade Manual Tutorial

- What Time Does DJ30 Index Open?

- Bollinger Band Technical Gold Indicator Trading Method Summary

- Is It Possible to Trade IT40 on MT4 Platform?

- Ehler MESA Adaptive Moving Average MA Buy Sell Trade Signal

- Techniques and Advice for Enhancing Forex Trading Psychology