Continuation Chart Patterns: Ascending Triangle and Descending Triangle Chart Pattern - Bull Flag and Bear Flag Continuation Patterns

When these continuation chart patterns are formed on forex charts they confirm that the current Forex trend is going to continue moving in the same direction.

These continuation chart patterns are used by traders to spot halfway points of the forex trend, this is because continuation chart patterns form at the halfway point of a trend.

There are four types of continuation chart patterns:

- Ascending triangle

- Descending triangle

- Bull flag/pennant

- Bear flag/pennant

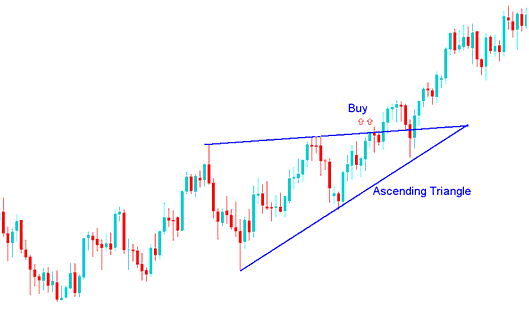

Ascending Triangle Continuation Pattern

The ascending triangle continuation chart pattern is formed in a uptrend and it shows that the forex upward direction of the market is going to continue.

>Ascending Triangle Continuation chart pattern highlights that there's a resistance level that the buyers keep pushing and each time they keep moving it higher, and once this resistance level breaks the forex price will continue moving upward.

The overhead resistance temporarily prevents the forex market from advancing higher, while the rising trend line beneath this continuation pattern signals that buyers are still present. An upside penetration of the upper line is a technical forex buy trading signal for a market breaking out from an ascending triangle continuation chart pattern.

Found within a uptrend, the ascending triangle continuation pattern forms as a consolidation period within the forex uptrend and indicates upside continuation of price movement will follow once price breaks to the upside of this continuation pattern.

The forex market formed an ascending triangle chart pattern during its uptrend which led to upside continuation of the upward trend move. The buy point is when price clears the upper sloping line and market continues moving upward.

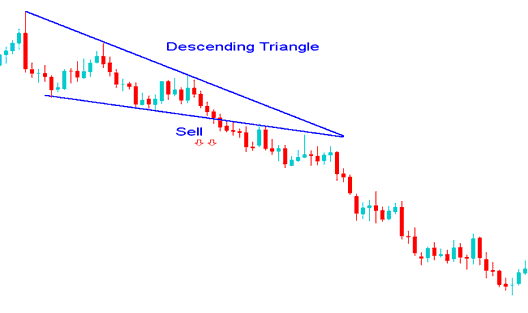

Descending Triangle Continuation Pattern

The descending triangle continuation chart pattern is formed in a downtrend and it shows that downward direction of forex price movement is going to continue.

Descending Triangle Continuation chart pattern highlights that there's a support level that the sellers keep pushing each time they keep moving it lower, and once this support level breaks price will continue moving downwards.

Support temporarily prevents the market from declining, while the descending sloping line above this continuation chart pattern signals that sellers are still present. A downside penetration of the lower line is a technical forex sell signal for a market breaking down from a descending triangle chart pattern, & this demonstrates selling will follow.

Found within a downtrend, the descending triangle continuation chart pattern forms as a consolidation period within the forex downtrend and indicates downside price move continuation will follow.

The market formed a descending triangle continuation chart pattern during its downtrend which led to further selling & continuation of the forex downtrend. The technical sell trading signal is when price breaks lower horizontal sloping line as selling resumes to push the forex market lower.

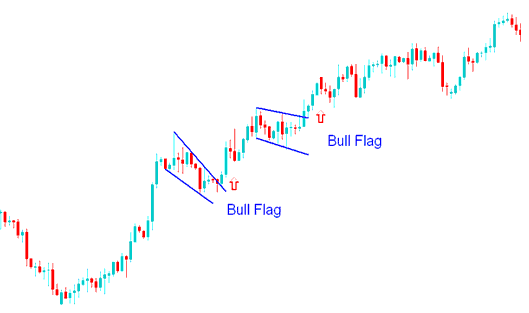

Bull Flag/Pennant Continuation Pattern

Bull Flag continuation chart pattern forms what looks like a rectangle. The rectangle is formed by two parallel lines that act as support and resistance for forex price until the price breaksout. In general, the bull flag pattern will not be perfectly flat but it will be sloping. Bull Flag Pattern is also known as Bull Pennant Pattern.

The bull flag is found within a uptrend. In this bull flag continuation pattern where the market retraces slightly, it's therefore a slight retracement with narrow price action which has a slight downwards tilt. The technical buy point of this Bull Flag continuation chart pattern is when price penetrates the upper line of the bull flag. The flag portion has highs & lows which can be connected by small lines which are parallel, giving this bull flag pattern the look of a small channel.

The bull flag continuation occurs at halfway point of a bullish upward forex trend & after a price breakout a similar move equal to the height of the flagpole is expected upwards.

The bull pennant above was just a resting period as the forex market gathered strength to break out and move higher and continue with the current upwards trend direction. The bull flag continuation signal was confirmed as the upper line was broken to the up-side.

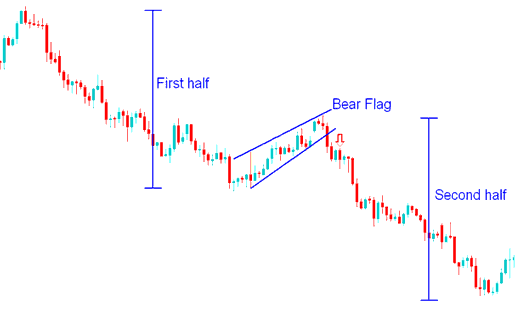

Bear Flag/Pennant Continuation Pattern

Bear Flag continuation chart pattern is found in a downtrend. The bear flag pattern is a continuation pattern where the price retraces slightly with a narrow price action which has a slight upward tilt. The technical sell point is when price penetrates the lower line of the inverted flag pattern. The bear flag portion has highs and lows which can be connected by small lines which are parallel, giving the bear flag pattern the look of a small channel.

The bear pennant above was just a resting period for the forex market prior to more selling. The bear pennant continuation signal was confirmed as the lower line was broken to the downside.