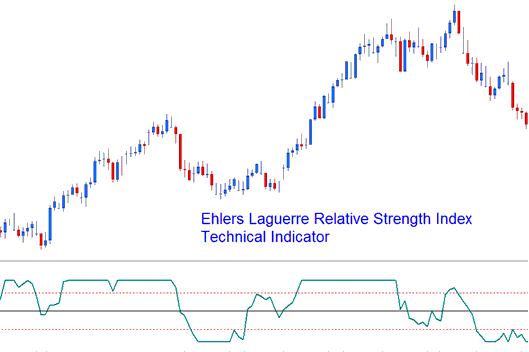

Ehler Laguerre RSI Analysis & Ehlers RSI Signals

Created and Developed by John Ehler.

Originally used to trade stock & commodities.

Ehler RSI applies a 4-part Ehler Laguerre filter. It slows low-frequency parts and spikes more than high ones. This creates smooth results with less data.

The Ehlers RSI uses numbers from 0 to 100, the middle line helps make trading choices, and the 80/20 marks show when something is too bought or sold.

The only tweak for this indicator is the damping gamma. Set it from 0.5 to 0.85 to fit your style.

Ehler Laguerre Relative Strength Index

FX Analysis and How to Generate Trading Signals

This implementation of Laguerre RSI uses scale of 0-100.

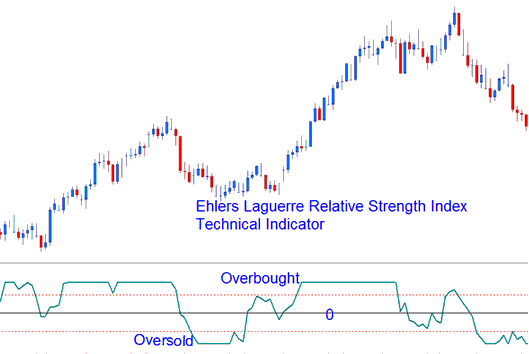

Forex Crossover Signals

Buy signal forms when Ehler RSI crosses over 50 and the center line.

Sell Signal- A sell signal is generated/derived when Ehlers RSI crosses below the 50 level and center Mark.

Oversold/Overbought Levels in Indicator

Oversold/Over-bought Levels in Indicator

Use Laguerre RSI to buy above 20% and sell below 80%. Watch for those crosses.

Study More Lessons and Tutorials & Topics: