Participants in the Forex and The for Profit Speculators

Forex Trading Market Participants - Participants Who Trade the Forex Market

The Forex currency market is traded for various reasons, each and every participant is in it for their own purpose. Shown Below is the list of the various players and the purpose of each of them:

- Governments

- Central Banks

- Banks

- Interbank Dealers

- Commercial Companies

- Retail Forex Brokers

- Hedge Funds

- Speculators and Investors

There are 3 main reasons to take part in trading the forex trading market

The role of each forex market participant is:

- One is to facilitate international commerce and actual transactions, where governments and international corporations convert and cash in profits made in foreign currencies into their local domestic currency and exchange currencies to facilitate international business by trading in the forex market and thus becoming participants.

- Corporate treasurers & money managers also take part when it comes to trading in forex market transactions so as to hedge against unwanted exposure to future price action movements.

- The third and most popular reason to trade the forex market is based on speculation for profit. In fact, it is estimated that less than 5% of the total transaction activities is what actually facilitates commercial transactions, the other 95% is speculation based trading. The role of this group of Forex traders is what we are most interested to cover on this website. Speculators are also popularly referred to as Day Traders.

About The Various Forex Market Participants

To know more about each of these forex market trading participants we shall look at the various categories of those taking part in Forex and also discuss how each of these influence the market.

- Governments

Governments participate in forex market trading for the purpose of settling payments from goods and services procured from other countries. A Government will have to first convert its countries currency into that of the country that it wants to do business with and it has to do this through the online FX trading market. Sometimes governments may also take part in Forex so as to influence the value of their currencies.

Governments are some of the major players taking part so as to facilitate commerce with other countries or with other Governments. Goods and services received by the Government may be acquired under a different currency than that of a particular government, therefore a Government may be required to first exchange their money to obtain the required currency for a particular transaction.

- Central Banks

The national central banks play an important role by controlling the money supply and setting the monetary policy of a their economy as well as controlling inflation through fiscal policy. They may also buy Forex money to keep as reserves within their custody.

Central banks are also major participants when it comes to forex market trade transactions as they may take part so as to either stabilize the exchange rate of their money in accordance with their monetary policy or even to carry out their specific monetary policy goals at a particular specific time.

For example central banks may devalue their currency so as to facilitate other countries to find it easier to do business in their country because the prices of goods will be more affordable than if their currency was expensive. This is so as to control the supply and demand of their money.

- Banks

These large banks transact billions of dollars daily on behalf of commercial companies, their customers and retail traders. Some of this transaction activity is undertaken on behalf of corporate customers while some activity comes from the banks treasury room which also conducts a large amount of transactions, where dealers are taking their own positions to make profits.

Banks carry out most of their transaction activities so as to facilitate payments between companies and individuals.

- Interbank Dealers

These dealers handle large amounts of business, facilitating interbank transactions and matching anonymous counterparts for comparatively small fees. With the increased use of the Internet, a lot of this business is conducted on electronic systems that are highly efficient in connecting many commercial banks.

These dealers deal with financial firms or retail brokers and provide institutional liquidity to these firms.

Interbank dealers are therefore major participants in Forex because all of the trades of investors are passed to these dealers who then offset these in the interbank market. Once traders places orders with their brokers who then pass these orders to the interbank dealers who then place these orders in the online interbank exchange, in what is known as providing liquidity.

- Commercial Companies

Multinationals and commercial companies taking part in international commerce participate in Forex to support their International commercial activities.

Commercial companies take part so as to settle transactions between them and other international and global companies.

- Retail Forex Brokers

The use of the inter net has brought about retail Forex brokers. These offer trading platforms, analysis, and strategic advice to customers and will place trades on behalf of their clients and facilitate these investors who do not have a lot of money. They will then provide capital to these retail investors in the form of leverage. These group only participates in as far as placing trades on behalf of speculators is concerned.

The fact is most banks do not undertake Forex trading on behalf of retail customers at all, and do not have the necessary resources or inclination to support these clients adequately.

The brokers will provide bid and ask quotes, depending on whether a retail investor wants to buy or sell, the trader will then buy or the currency at the current price quotes(bid quote - buyer will buy at this price, ask quote - the seller will obtain the currency at this price).

The role of this group is to only facilitate transactions between the market and the traders for a small markup called spread. The group does not therefore hold any orders of their own, they just facilitate the trading.

- Hedge Funds

Hedge funds use aggressive speculation methods to make profits. Hedge funds are investments that are under the management of experts and professional money managers, the size and liquidity of forex is very appealing and the leverage available in these markets also allows such funds to invest in with billions of dollars at a time.

Investors and Speculators - The Majority Participants

This group forms the majority of the transactions in the trading forex market place: these are major players in forex trade accounting for 95 % of all daily Forex trade market turnover.

Forex or is the largest and least regulated market providing the greatest liquidity to investors. The daily turnover volume is around $7.2 trillion. By comparison, the NYSE daily volume averages $500 billion a day.

The Forex spot market is the most liquid. Spot, meaning that transactions are settled within one banking day. There is no central exchange of physical location. Transactions take place over-the-counter, 24-hours a day directly between the two telephones and computer.

Participants include central banks, corporations, individual retail investors, and hedge funds. With the advent of electronic trading platforms, self-directed investors and smaller financial firms now have access to the same liquidity as larger participants.

Speculation makes up 95% of the daily volume. The other 5% of daily volume consists of governments and commercial companies converting one currency into another from buying and selling goods and services. This makes the speculators to collectively to become the big players. Speculators provide a lot of liquidity and should therefore a government, a company or an individual want to exchange their currency for another there is always someone willing to buy at any time of the day or night and because transactions are settled in the online interbank exchange where all the transactions are done anonymously.

If there was no one wanting to buy the currency you want to exchange, then you would go to transact your money and be told you have to wait to someone who wants to exchange their money with you and that is the only time you can transact. But because of the online floating forex market, there is always someone willing to transact their money with your money and they can do this from anywhere in the globe as long as they are connected to the interbank.

Most of these speculators will transact currencies not for purpose of facilitating commerce, but for the purpose of making a profit from the movement of prices.

The speculators accomplish one of the most important functions of the online forex market, and that is to provide liquidity and thus play an important role taking over the risks that other commercial participants hedge. The speculation activities are not clearly defined because many of the players such as banks also have speculative interests same as that of the retail investors.

Forex is very popular with investors and speculators because of the liquidity with which positions can be opened and closed and also because of the large amount of leverage that can be obtained from the online brokers thus increasing profit margins for these participants.

The structure of the online exchange is:

Interbank Market >>> Interbank Dealer (Forex Liquidity Provider) >>> FX Broker >>> Retail Investors

Retail investors trade currencies through online brokers, using trading platforms/software that connects them with their broker through an inter-net connection. Through this online platforms the traders can login and then trade Forex from anywhere in the world provided they have an internet connection.

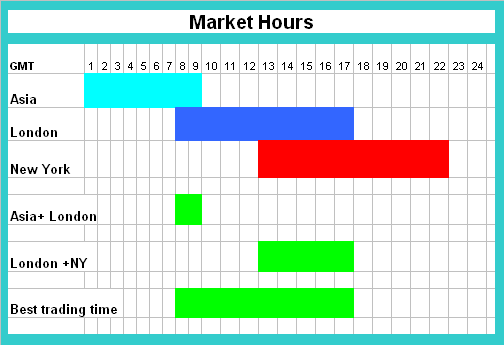

Most of these investors will only take part and transact during the busiest hours and only trade the major currencies: EURUSD, USDJPY, GBPUSD and USDCHF.

Best Forex Trading Hours - How to Trade the Forex Market

To help beginner traders learn how to trade in forex market and practice, online Forex brokers offer a free practice account called a practice account that beginners can practice with risk free without depositing any money, this demo also helps beginners learn how the Forex trading platform works.

About Learning for Speculators and Day Traders

To also help novice traders to learn how online Forex trading works, we have provided a collection of learning guides and strategies that can help the beginners to learn how to trade forex market currencies and get the knowledge required to make money. All These lesson can be found on this Page: Learn Forex Topics for Beginners and you can also find a list of all the popular Strategies that you can use to analyze currency charts on this page: Forex Trading Strategies That Work.