Inverted Hammer Candlestick - Shooting Star Candlestick - Inverted Hammer vs Shooting Star Candlesticks

Inverted Hammer Bullish Candlestick - Shooting Star Bearish Candlestick - Bullish vs Bearish Candles Patterns

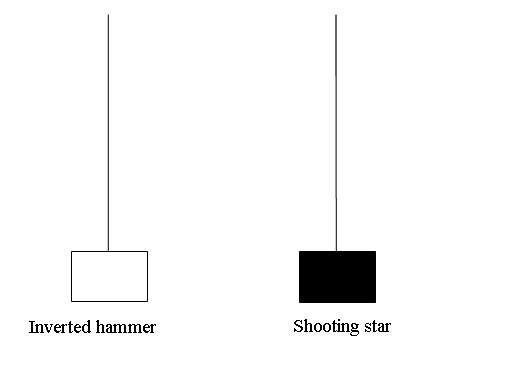

Inverted Hammer Candlestick Pattern and Shooting Star Candlestick Setup candle-sticks look alike. These candlesticks patterns have a long upper shadow and a short body at the bottom. Their fill color doesn't matter. What matters is the point where they appear whether at the top of a market trend (star) or the bottom of a market trend (hammer).

Difference is that inverted hammer is a bullish reversal pattern while shooting star is a bearish reversal pattern.

Upward Trend Reversal - Shooting Star Candles

Downward Trend Reversal - Inverted Hammer Candles

Inverted Hammer Candlestick Pattern and Shooting Star Candlestick Setup Candles Chart Setups

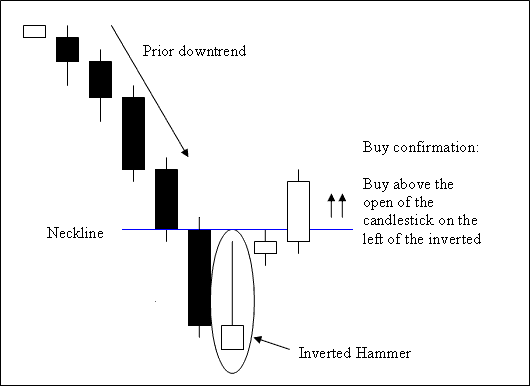

Inverted Hammer Candle

This is a bullish reversal candle setup. It forms at the bottoms of a trend.

Inverted hammer occurs at the bottom of a downtrend and indicates the possibility of market reversal of the downward trend.

Inverted Hammer Candle

Analysis of Inverted Hammer Candle Pattern

A buy is completed when a candle closes above neck-line, this is opening of the candle on left side of this pattern. The neck line region in this acts as a resistance zone.

Stop orders for the buy trades should be set few pips below lowest price on the recent low.

An inverted hammer is named so because it indicates that the market is hammering out a bottoms.

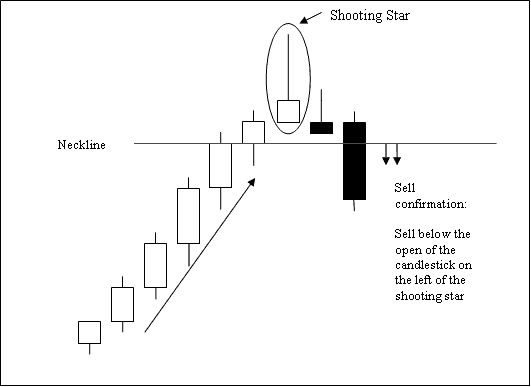

Shooting Star Candlestick

This is a bearish reversal candle pattern. It occurs at tops of a market trend.

It occurs at the top of an uptrend where the open price is same as the low & price then rallied up but was pushed back down to close near the open.

Shooting Star Candlestick

Technical Analysis of Shooting Star Candlestick Pattern

A sell is completed when a candle closes below neckline, this is opening of the candle on left side of this pattern. The neck-line in this case is a support zone.

Stop orders for the sell trades should be set a few pips above highest price on the recent high.

The Shooting Star candle-stick is named so because at the top of an upwards market trend this candle pattern looks like a shooting star up in the sky.