Leverage & Margin Explanation and Examples

Margin needed: This is the money your broker needs from you to start a trade. It is shown as a percentage.

Equity: This represents the total capital available in your trading account.

Used margin means the cash in your account tied up from buying a currency lot. It shows up in your open trades list. After you start a trade, that money stays locked and you can't touch it for fresh deals.

In other terms, because your online broker has opened up a trade position for you using the capital you have borrowed from the broker, you must keep and maintain this usable margin for your account as a collateral to allow you as the trader to continue using this leverage that the online broker has issued you.

Free margin means the money in your trading account you can use to make new trades. This is the amount of money in your account that hasn't been used yet because you haven't made any trades with it - this is also very important for you as an investor and trader because it lets you keep your current trades going, as explained below.

High leverage can drain your free margin fast. It may drop below a key level. Then, your broker auto-closes all open trades. This leads to big losses. The broker acts to protect the loan you took from them. Open trades left alone could cost them more.

Always keep plenty of free margin in your forex account. To manage this, never risk more than 5% of your balance on a trade. Experts suggest sticking to just 2% for safety.

Understanding the Difference Between Broker Set Forex Leverage and Actual Used Leverage

If the established leverage ratio is 100:1, this indicates that as a forex trader, you can borrow up to 100 dollars for every dollar present in your account. However, it is not mandatory to borrow the full 100 dollars for each dollar in your account: you may opt to utilize a leverage of 50:1 or 20:1 instead. In this scenario, even though the leverage option is set at 100:1, the actual leverage you will use will be the 50:1 or 20:1 that you have chosen for your trade.

Example:

You have $1000 (Equity)

Set leverage is 100:1

Leverage Used = Amount utilized / Equity

1 Contract, $100,000 Lot

Buying one standard forex lot means 100,000 units, so you spend that amount.

= 100,000/1000

= 100:1

0.5 Contract, $50,000 Mini Lot

If you buy one 0.5 lots/contracts which is equal to $50,000 you'll have used

= 50,000/1000

= 50:1

0.2 Contract, $20,000 Mini Lot

If you buy one 0.2 contracts/lots which is equal to $20,000 you will have used

= 20,000/1000

= 20:1

0.2 Contract, $10,000 Mini Lot

If you enter a trade for 0.1 lots/contracts, which corresponds to a notional value of $10,000, you will have utilized

= 10,000/1000

= 10:1

In these three cases you can see that even though the set leverage is 100 : 1

You can use leverage ratios like 100:1, 50:1, 20:1, or 10:1, depending on how big your position is.

So, Why Not Opt Directly for the 10:1 Leverage Setting as the Maximum Level for Your Account? The answer lies in adhering to prudent risk management protocols, which actually recommend traders utilize leverage lower than this threshold?

This question might seem straight forward but it is not, because when you trade you use borrowed money known & referred to as Leverage. When you borrow capital from anyone or a bank you as a trader must maintain security/collateral to get a loan, even if the collateral is depending and based on the monthly deduction from your own salary, same thing with FX Trading.

In the context of forex trading, the required collateral placed with the broker is termed margin, which represents the deposited capital.

This figure is calculated instantly as you conduct trades - it updates whenever you open or close positions. To retain the borrowed capital, a trader must maintain a specific amount referred to as required capital (which is their initial deposit).

Now if Your Leverage is 100:1

If you have $1,000 and use a leverage of 100:1 to buy one standard forex lot for $100,000, the margin on this trade is the $1,000 in your account. This is the money you will lose if the trade goes against you. The other $99,000 is borrowed from your broker, and they will automatically close the trade once the market has taken your $1,000.

However, this scenario is applicable only if your broker has established 0% Margin Requirements before automatically closing your trade positions.

With 20% margin, trades close auto when balance hits $200. This prevents further losses.

For 50% Margin requirement of this free margin level before closing your open forex positions mechanically/automatically, then your open trades will be closed once your account balance gets to $500

If your broker set 100% Margin prerequisite of this level before closing out your open trade positions automatically/mechanically, then your trade will be closed once your account balance reaches $1,000 dollars: Meaning the trade that you'll open will close out as soon as you execute it because even if you pay 1 pip spread your account balance will get to $990 & the needed Margin requirement percentage level is 100 percent i.e. $1,000, hence your open position orders will immediately get closed.

Most online brokers do not require a 100% Margin, but some do. These brokers are not suitable for you. It's better to choose online brokers that have lower margin requirements, like 50% or 20%. Brokers with a 20% margin requirement are often the best choice because they reduce the chance of your trades being closed out unexpectedly, as shown in the example above.

To understand the needed margin amount that your platform figures out for you - The MetaTrader 4 Platform Software shows this as "Margin Requirement", which is shown as a percentage, and a higher percentage means your open trades are less likely to be closed.

For Example if

Using 100:1

If leverage ratio is 100:1 & you transact 1 Mini Lot, equals to $10,000

$10,000 (mini lot) divided by 100:1, your used funds is $100 dollars

Calculation:

= Capital Used * Percentage

Equals $1,000 divided by $100 multiplied by 100%:

Margin Requirement = 1,000 %

Trader and Investor has 980 % above the requirement amount

Using 10:1

At 10:1 leverage with one mini lot, that's $10,000 traded.

$10,000 (representing a mini lot) scaled down by a 10:1 ratio results in your employed capital being $1000.

Calculation:

= Capital Used * Percent

Equals $1,000 times the percentage

Margin Requirement = 100%

The Investor and Trader segment possesses capital exceeding the mandated threshold by 80%.

When a forex trader has higher leverage, it means they have more extra money than they need (also known as more "Free Margin"), so their trades are less likely to be stopped out. This is why traders pick the 100:1 option for their account, but they still follow their own rules for managing risk when trading, so they don't trade with more than a 5:1 leverage ratio.

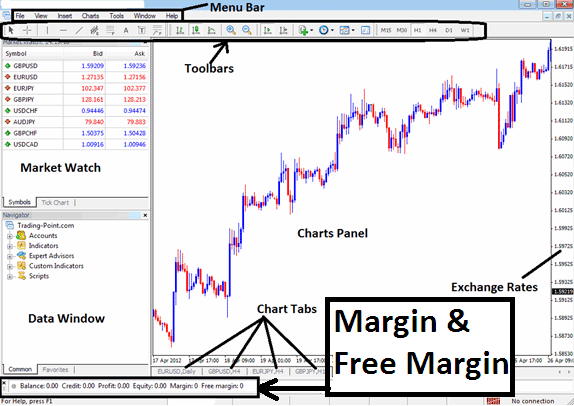

These Margin Levels are Shown on the Software Screen Shot Below as an Example:

Margin and Free Margin is displayed by the MetaTrader 4 Software

More Topics:

- Best Time to Trade USD/NOK EST

- Application of the Bollinger Band Trading Indicator in Stock Index Chart Analysis

- How Can I Trade Charts Trading Analysis using Trade Strategies?

- How Can I Add US 100 in MT5 US 100 Trade App?

- What is Ultimate Oscillator Indicator?

- Learn XAUUSD Analysis Step By Step Free

- Average True Range ATR Trading Method That Works

- Bollinger Band MT4 Indicator

- List of XAU USD Indicators for Setting Stop Loss XAU USD Order & Where to Set Stops in XAU USD Charts

- Forex Moving Average MA Convergence Divergence Automated Expert Advisor(EA) Setup