Short-Term and Long-Term Price Periods for Moving Average (MA) Trading

A trader retains the ability to modify the time periods utilized in calculating the Moving Average (MA).

When a trader employs short price periods, the moving average will respond more quickly to price fluctuations.

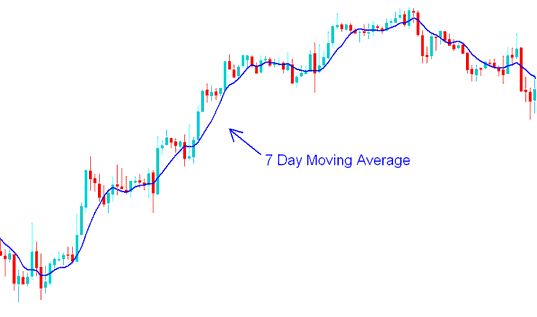

If a forex trader uses the 7 day MA, the MA indicator will respond to price changes quicker than a 14 day or 21 day Moving Average. However, if you use short time periods to figure out the MA, the indicator might give you the wrong info (false signals).

7 Day Moving Average(MA) - Moving Average Strategy

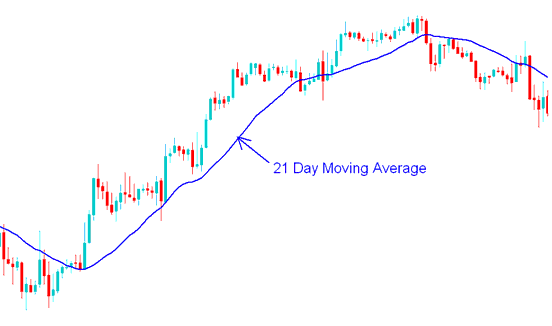

If a different trader employs longer time frames on charts, the moving average (MA) will respond to price fluctuations more slowly.

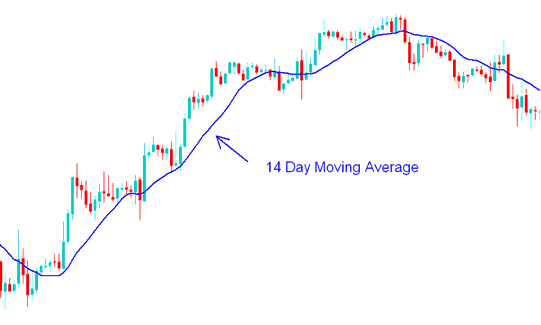

Take a 14-day MA for less false moves. It lags but stays steady on whipsaws.

14 Day Moving Average(MA) - MA Strategy Example

21 Day Moving Average(MA) - MA Strategies Example

Get More Tutorials and Lessons & Topics:

- Mastering XAU/USD Trading with Course Tutorials

- Momentum XAU/USD Technical Indicator Analysis

- Spotting Divergence on XAUUSD Charts for Trades

- Continuation patterns: Examples of ascending triangles and descending triangles

- Stock Index Trading Hours and Market Opening Times

- Fundamental Analysis for Trading/Transacting Lesson Tutorial

- Downloadable Nikkei225 strategy guide tailored for beginner traders provided.