Short-Term Forex Strategies with Moving Averages

Top Forex Strategies - Short-Term MAs Moving Averages Indicator Strategy

Short term moving averages are moving averages that use shorter time periods as the settings for calculating these short term moving averages. By using short term periods to calculate the moving averages it means that the moving average indicator will react faster to price changes. Short-term moving averages are used more by scalpers and day traders.

Short-span forex transactions typically rely on brief historical price windows, such as the metrics derived from the 10-period and 20-period moving averages.

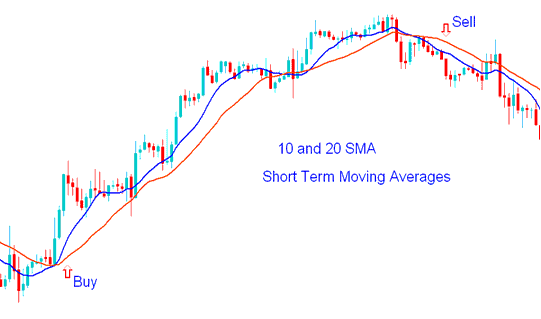

In the example below, we use 10 and 20 Simple Moving Averages for forex signals. They spot trends early.

Short-Term Currency Trading utilizing Moving Averages (MAs) - An Illustration of How to Trade Forex with MA Indicators

Scalper Trader - Using MAs

One of the most popular ways to analyze forex chart trends, especially in scalping, is by using moving averages.

The purpose of the moving average forex indicator is to facilitate enhanced forex analysis before executing a signal to enter the market. Setting short-term forex goals based on the moving average can aid scalpers in recognizing market trends and making informed trading decisions.

Most of the signals can be established using a specific price period for the Moving Average Indicator. The forex Moving average indicator determines whether the trader will trade in the short-term or long-term. Additionally, the price action is above/below this moving average indicator it determines the price trend of the market price for the day.

Should a substantial proportion of the market price action be situated below the Moving Average trading indicator, the bias for the day's forex trend is considered to be downward. Many traders utilize the MA as a dynamic measure of support or resistance to pinpoint precise moments for initiating a forex trade: if the price tests or touches the MA consistent with the market's overall direction, a forex trade is then executed.

Traders draw forex moving averages on charts. The spot where they cross the price helps pick entry and exit points for trades. Prices swing back and forth all the time. The market keeps bouncing off the average. This pattern creates signals to buy or sell.

Simple moving averages are computed based on the analysis of prices over a specified period, utilizing sufficient data for calculation. Their analysis has offered numerous forex scalpers valuable guidance on when and how to engage in forex scalping trades.

Medium-Term Strategy

Medium term forex MA strategy will use the 50 period MA.

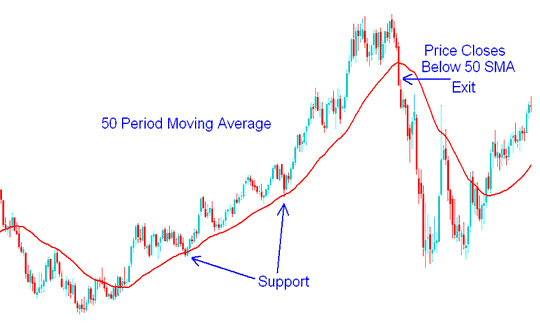

The 50 period MA Moving Average acts as support resistance level for the price.

In an established uptrend, the 50-period Moving Average will function as a support level, wherein the price is expected to rebound upwards subsequent to interacting with the Moving Average (MA). Should the market close beneath this technical indicator, it signals an opportune moment to exit the trade.

Forex 50 Moving Average Period Support - Moving Average Forex Strategy Example

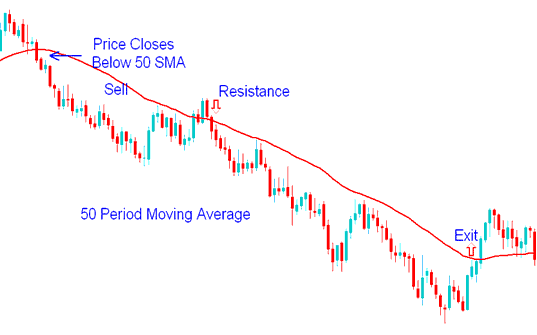

In a downward forex trend, the 50-period moving average acts as resistance. Prices are expected to fall after touching this indicator. If the market closes above it, that signals an exit opportunity.

50 MA Period Resistance - Strategies Example

50 Day Moving Average(MA) Forex Technical Analysis

In an uptrend, keep an eye on one key line. It's the 50-day moving average. Prices above it signal good trades. If prices drop below it on high volume, get ready. A forex trend reversal might be coming.

A 50-day moving average (MA) indicator is calculated using market data from the past ten weeks. This line adjusts daily and highlights whether the price trend is upward, downward, or sideways.

You should usually only buy when prices are higher than their 50 day MA. This tells you the current forex market is going upward. You always want to trade along with the trend, not against it. Many traders only start/do trade orders in the direction of the market price trend.

Forex prices often find support repeatedly at this 50-day moving average. Big investing companies pay close attention to this technical level. When these large organizations notice a forex trend dropping to its 50-day line, they view it as a chance to add to their current trade or begin a new forex trade at a good price.

What is the implication if your chosen currency pair declines and crosses below its 50-day moving average? If this crossover is accompanied by heavy trading volume, it serves as a strong sell indication in forex. This signals that substantial institutions are liquidating their holdings, which can precipitate a sharp price decline, even if underlying economic fundamentals still appear sound. Conversely, if your currency pair dips marginally below the 50-day line on low volume, observe and monitor its behavior in the subsequent days, and take necessary corrective measures if warranted.

LongTerm Strategy

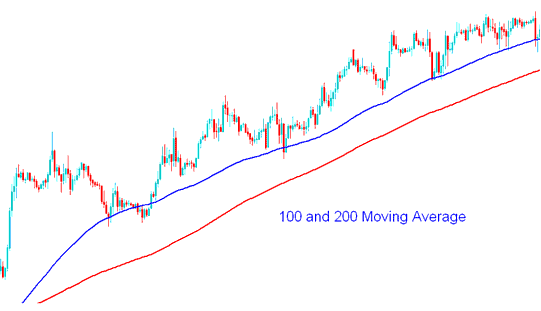

A long-term foreign exchange plan will employ extended periods, such as the 100 and 200 MAs, which serve as the market price's long-term support and resistance zones. Price will frequently respond to these support and resistance levels because these 100 and 200 MAs are used by a large number of traders.

100 & 200 MAs - How to Trade Forex Using Moving Average Strategies

In Forex, traders use both basic and technical analysis to find out if a currency pair is a good choice to buy or sell.

When analyzing FOREX, FOREX traders who want to measure how much of a currency pair is being bought and sold use the 200 day moving average to study data in various ways.

Forex traders know that the basic use of the 200 day MA is for charting the support resistance level over a long time. If the market price is over the 200 day MA then the trend is going up, but if it is under it then the forex trend is going down.

In forex trading, supply and demand can be measured by calculating the average closing price over the past 200 sessions. This Moving Average reflects past price movements, highlighting how the 200-day average has shifted over time.

The 200-day moving average is such a staple in forex because traders have used it for years and it gets results. The classic move? Buy when the market's above the 200-day average, sell when it drops below.

By using this moving average tool for forex, traders can get alerts when a currency pair goes above or below its 200 day Moving Average, and they can then use their technical analysis to decide whether to buy or sell.

Get More Topics and Tutorials: