RSI Strategies

- RSI Overbought and Oversold Levels Explained

- Setups for Trading RSI Divergence

- Spotting RSI Bullish and Bearish Classic Divergence Patterns

- Spotting Hidden Bullish and Bearish Divergence with RSI

- Swing Failure Strategy

- RSI Trend Line Setups

- RSI Summary Overview

Relative Strength Index Strategy

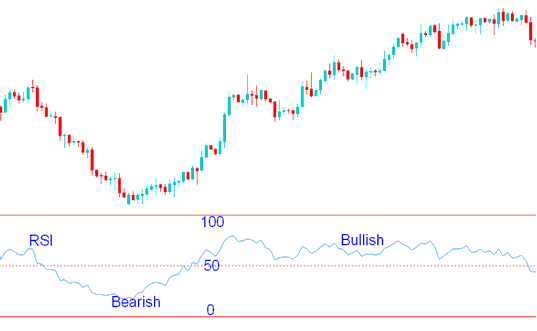

The RSI is among the most favored forex indicators utilized in the Forex market. It functions as an oscillator that fluctuates between 0 and 100, serving as a trend-following indicator that measures the vigor of the forex trend: readings above 50 denote an uptrend, whereas readings below 50 suggest a downtrend in Forex.

RSI Measures Momentum of a Trend.

The middle line for the RSI is 50, and when the line crosses it, this shows changes from a rising to a falling trend, or the other way around.

When above 50, buyers have more power than sellers, and the price on the forex chart will keep going up if the RSI stays above 50.

Below 50, sellers outpace buyers. The forex price keeps falling while RSI stays under 50.

RSI - How to Trade FX with RSI Indicator

In the forex case mentioned above, the price continued to follow a downward market trend whenever the forex indicator was below 50. While RSI was below 50, the price kept declining. The change in energy from sell to buy and the conclusion of the negative trend were shown by the RSI crossing 50.

When the RSI crossed above 50, the price began trending upwards, signaling a shift in the forex market trend from bearish to bullish. The upward momentum continued as RSI consistently stayed above 50.

In the forex chart example, during an uptrend, RSI sometimes dips. But it stays above 50. That signals mere pullbacks, as the overall trend stays up. RSI below 50 would shift the trend. The 50 line separates bull from bear signals.

The RSI defaults to a 14-day period. J. Welles Wilder suggested this when he created it. Traders often use 9 or 25 days instead.

The RSI period changes with your forex chart timeframe. On a daily chart, 14 periods mean 14 days. On a 1-hour chart, they mean 14 hours. We use a 14-day average here. You can swap it for your own chart timeframe in trading.

To Calculate RSI Indicator:

- The number of days which a forex market is up is compared to the number of days that the currency market is down in a given time period.

- The numerator in the basic formula is an average of all the forex trading sessions that finished with an upward price change.

- The denominator is an average of all the downwards forex sessions closes for that period.

- The average for the downwards days is calculated as absolute numbers.

- Initial RSI is then turned into an oscillator indicator.

Large one-sided price movements during a single Forex session can distort RSI calculations, often leading to a false signal or a whipsaw effect manifested as price spikes.

RSI Centerline: The center line for this forex indicator is set at 50. If RSI is above 50, the market's in a bullish phase - average gains are higher than losses. If it's below 50, you're looking at a bearish phase, with prices usually closing lower than where they started.

Wilder set RSI overbought at 70 and oversold at 30. When the forex market hits those levels, it means price moves have probably gone too far.

Get More Lessons and Tutorials and Courses: