Forex William Percent R Expert Advisor Setup - Setting Up William Percent R Expert Advisor

Forex William Percent R Expert Advisor Setup - Setting Up William Percent R Expert Advisor - A trader can come up with an William Percent R Expert Advisor based on the William Percent R indicator explained below.

Forex William Percent R Expert Advisor rules can be combined with other indicators to come up with other Expert Advisor Bots that trade using rules based on two or more indicators combined to form a system.

Williams Percent R Analysis and Williams Percent R Signals

William's % R Indicator Created by Larry William

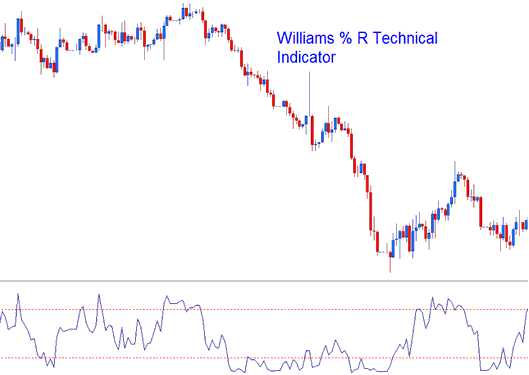

Williams % R indicator is pronounced as William's percent R indicator. William %R Indicator is a momentum oscillator used to analyze overbought & oversold levels in the markets.

The Williams % Range oscillator is similar to the Stochastic, apart from that fact that the % R is plotted upside down on a negative scale that's from 0 to -100 and the indicator does't apply a smoothing factor.

Williams % R, Percent R Indicator - Indicators

The Williams Percent R indicator analyzes the association of the closing prices relative to the High & Low range over a selected number of n candles.

- The closer the closing price of a candle is to the highest high of the range selected the closer to zero the Percent R reading will be.

- The closer the closing price of a candle is to the lowest low of the range selected the closer to -100 the Percent R reading will be.

When doing analysis a trader should ignore the minus sign placed before the value, for example -40, the - sign should be ignored, just remember the indictor values are placed in an upside down manner.

- At zero: If the closing price of the candle is equivalent to the highest high of the range the William % R reading will be 0.

- At -100: if the closing price of the candlestick is equal to the lowest low of the range the Williams % R reading will be -100.

Analysis of Williams Percent R Indicator

Overbought/Oversold Levels on Indicator

- Overbought- William's % R values from 0 to -20 are considered overbought while

- Oversold- Williams % R values from -80 to -100 are considered oversold.

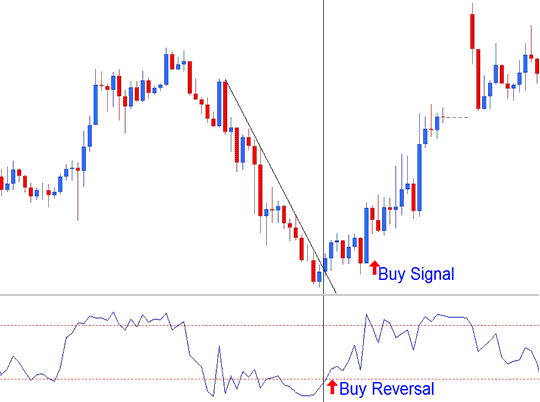

As for overbought/oversold levels it's best to wait for a currency pair to change direction before taking a signal in opposite direction. For Example if a forex pair is oversold it's best to wait for the trend to reverse & begin to head in an upwards direction before buying the currency pair.

Trend Reversal Signals

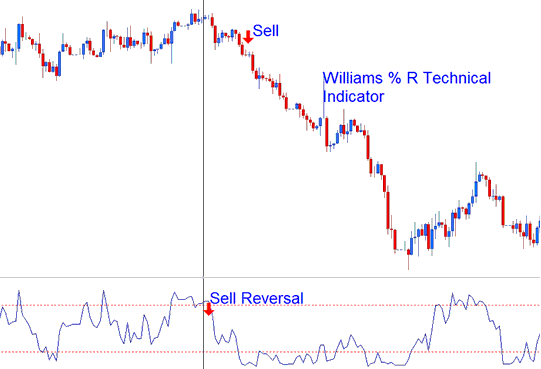

The William Percent R indicator used to predict a trend reversal signal when trading a forex pair. The Williams % R indicator always predict a reversal using the following method

Bearish Reversal Signal- Williams Percent R indicator forms a peak & turns down a few days before the price trend peaks and turns down. The example below shows % R giving a reversal signal before price starts to head down and change to a down trend.

Bearish Reversal Signal after Uptrend

Bullish Reversal Signal- Williams Percent R indicator forms a trough & turns up a few days before the price trend bottoms & turns up.

Bullish Reversal Signal after Downtrend