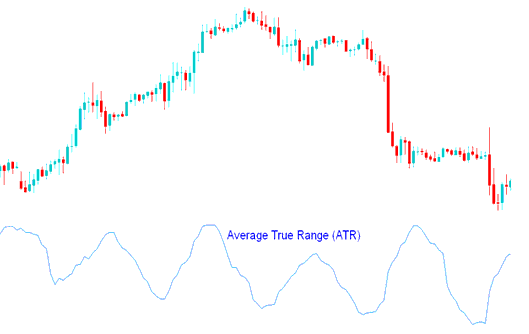

Average True Range ATR Technical Analysis & ATR Signals

Developed by J. Welles Wilder

This technical indicator is a measure of volatility - it measures the range of stock price movement for a particular stock price period. The ATR is a directionless indicator & it does not determine the direction of the trend.

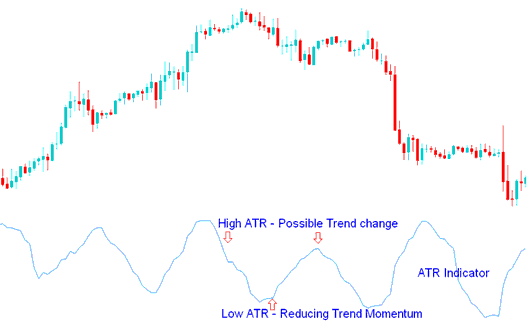

High ATR values

High Average True Range indicator values indicated market bottoms after a sell off.

Low ATR values

Low Average True Range values showed extended periods of sideways stock price movement- Price Range, such as those found at market tops and consolidation periods. Low ATR values are typical for the periods of sideways movement of long duration which happen at the top of the market and during consolidation.

Calculation

This technical indicator is calculated using the following:

- Difference between the current high & the current low

- Difference between the previous closing stock price & the current high

- Difference between the previous closing stock price and the current low

The final Average is calculated by adding these values & calculating the average.

Technical Analysis & How to Generate Trading Signals

Average True Range technical indicator can be analyzed using the same principles as other volatility technical indicators.

Possible trend change signal - The higher the value of indicator, the higher the probability of a trend change;

Measure of trend momentum - The lower the indicator’s value, the weaker the trend movement.

Analysis in Indices Trading