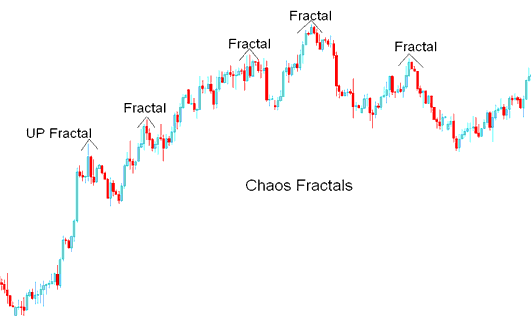

Chaos Fractals Stock Indices Analysis & Chaos Fractals Stock Indices Signals

Created by Bill Williams

A fractal is formed by three price bars

It is used to detect the bottom or the top.

Up Fractal- defined as a middle bar with 2 lower highs on each side (A- shaped)

Up Fractal

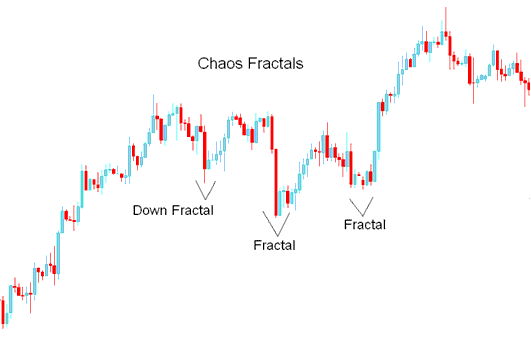

Down Fractal- defined as a middle bar with two higher lows on each side (V-shaped)

Up Fractal

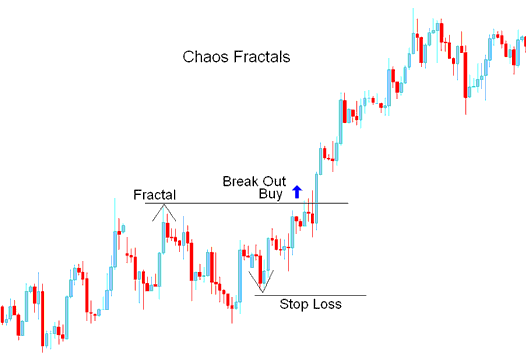

Stock Indices Analysis & How to Generate Signals

Breakout Trading

The break out method of using fractals to initiate trades is to take trades based on the direction of a price breakout above or below most recent fractal.

Buy Stock Indices Signal

If price breaks above the most recent Up Fractal enter long.

Stop losses should be set below the lowest low of the most recent Down Fractal or the second most recent Down Fractal.

Buy Stock Indices Signal Break Out Trading

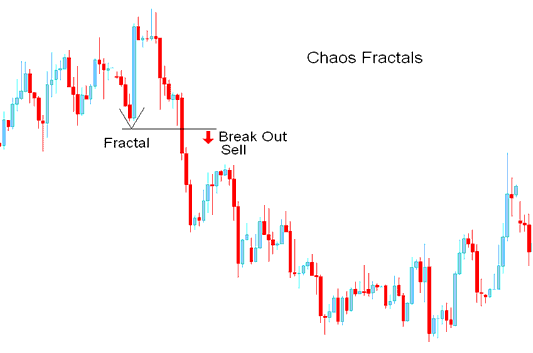

Sell Signal

If price breaks below the most recent Down Fractal enter short.

Stop loss orders should be set above the highest high of the most recent Up Fractal or second most recent Up Fractal.

Sell Signal Break Out Trading