Trend Technical Indicators

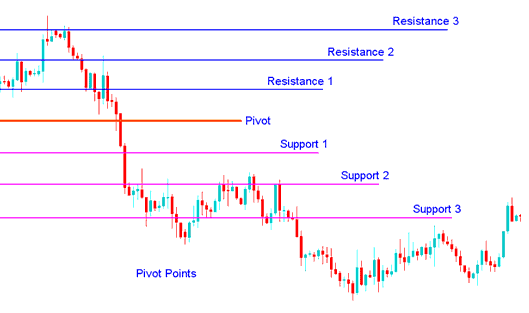

Pivot Points are used by traders to find support and resistance levels based on the previous day's price action.

This technical indicator is a very useful tool that use the previous bars' highs, lows and closings to project support & resistance levels for future bars.

This technical indicator provides an idea of where key support and resistance should be. Place the pivot points on your stock charts and price will bounce off one of these levels. These levels are used by traders to determine market tops, market bottoms or stock trend reversals.

- Daily pivots points are calculated from previous day's high, low, close

This technical indicator is shown below

Analysis in Indices Trading

The central pivot itself is the primary level, which is used to determine the trend

The other support & resistance levels are also important in calculating areas that can generate significant market movements.

This technical indicator can be used in two ways

The first way is for determining overall trend: if the pivot point is broken in an upward movement, then the market is bullish, and vice versa. However, pivot levels are short-term stock trend indicators, useful for only one day until they need to be recalculated.

The second method is to use these points to enter and exit the markets. This technical indicator is a useful tool that can be used to calculate the areas that are likely to cause price movement.

These points should be used conjunction with other forms of analysis such as Moving averages, MACD & stochastic oscillator.

This technical indicator can be used in many different ways. Here are a few of the most common methods for utilizing them.

Trend Direction: Combined with other analysis techniquesmethods such as overbought/oversold oscillators, volatility measurements, the central point might be useful in determining the general trending direction of the market. Trades are only taken in the direction of the trend. Buy signal occurs only when the market is above the central pivot points and sell signal occur only when the market is below the central pivot points.

Price Breakouts: A bullish signal occurs when the market breaks up through the central pivot points or one of the resistances (typically Resistance Level 1). A bearish signal occurs when the market breaks down through the central point points or one of the supports (typically Support Level 1).

Trend Reversals:

- A buy signal occurs when market price moves toward a support level, gets very close to it, touches it, or moves only slightly through it, & then reverses and moves back in opposite direction.

- A sell signal occurs when market price moves toward a resistance level, gets very close to it, touches it, or moves only slightly through it, & then reverses & moves back in opposite direction.

Stop Loss and/or Limit Profit Values Determined by Support/Resistance: This technical indicator may be potentially helpful in determining suitable stoploss &/or limit profit placements. For examples, if trading a long breakout above the Resistance 1 it might be reasonable to position a stoploss.

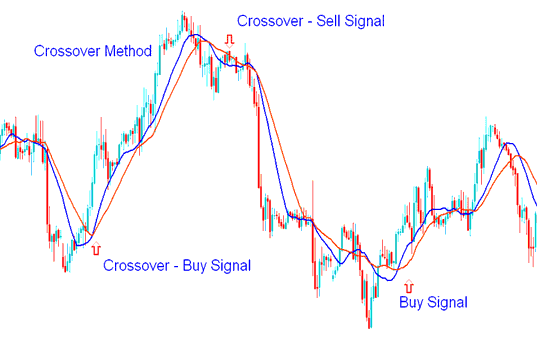

Combining with Moving Average Cross-over System

A good indicator to combine and trade reversal stock signals is the MA cross over which can be used to confirm the direction of a reversal signal.

An investor can then open an order once these 2 indicators give a trading signal in same direction.

MA Crossover Technique

Moving average crossover method that can be combined with this indicator to come up with a stock indices system for generating buy and sell signals.

To download this Pivot points Indicator:

https://c.mql5.com/21/9/pro4x_pivot_lines.mq4

Once you download the indicator. open it with the MQL4 Language Meta-Editor, Then Compile the technical indicator by pressing Compile Button and it'll be added to your MT4.

Note: Once you add it to your MetaTrader 4, the indicator has additional lines named MidPoints, to remove the extra lines open MQL4 Meta Editor(short-cut keyboard key - press F4), and change line 16 from:

Extern bool mid-pivots = true:

To

Extern bool mid-pivots = false:

Then Press Compile again, and the indicator will then appear as exactly illustrated on this website.