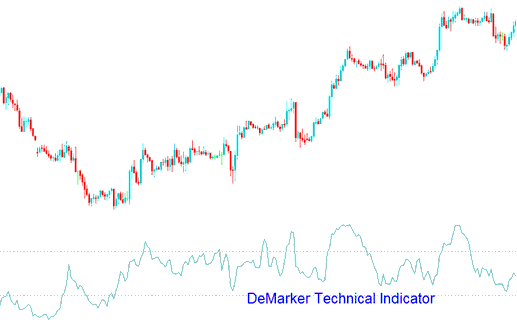

DeMarker Technical Analysis & DeMarker Signals

Developed by Tom Demark.

This technical indicator is designed to overcome the general shortcomings of traditional overbought & oversold technical indicators.

The DeMarker is used by Stock traders to predict potential market bottoms and tops by utilizing price data comparisons from one bar to the next.

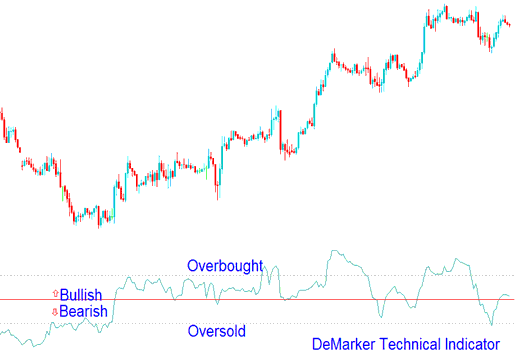

Indices Technical Analysis & How to Generate Trading Signals

This technical indicator is interpreted in the same way as other overbought / oversold indicators. Overbought level is marked at 70 while oversold is marked at 30.

Bullish Reversal Signal - When the DeMarker falls below 30, the bullish price reversal should be expected.

Bearish Reversal Signal - When the DeMarker rises above 70, the bearish price reversal should be expected.

Analysis in Indices Trading

If you use longer time frames to draw the Demarker, you will get to catch the long term market trends. If you use the short time frame based on shorter periods you can enter the market at the point where the risk is minimum and you can plan the time of transaction so that it is within the major trend.