Reversal Setups

These patterns are formed after the stock market has had an extended move up or down and the price reaches a strong resistance or support respectively.

When price reaches such a point it starts to form a pattern. Since these formations are frequently formed it is easy to spot them once you learn how and start using them. There are four types:

- Double Tops

- Double Bottoms

- Head & shoulders

- Reverse Head & shoulders

This learn stock indices tutorial will only cover double tops and bottoms, for the other 2, read this other tutorial: head & shoulders and reverse head & shoulders

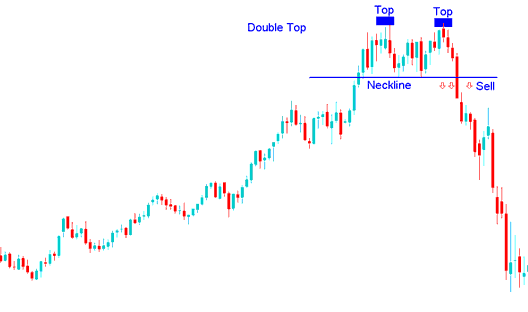

Double Tops

This is a reversal stock pattern that forms after an extended upwards trend. As its name implies, this setup is made up of 2 consecutive peaks that are roughly equal, with a moderate trough between.

This formation is considered complete once price makes the second peak & then penetrates the lowest point between the highs, called the neck-line. The sell signal from the formation forms when the stock market breaks-out below the neck-line.

In Stock Indices, this formation is used as a early warning signal that a bullish trend is about to reverse. However, it is only confirmed once the neck-line is broken and the stock market moves below neck-line. Neckline is just another term for the last support level formed on the chart.

Summary:

- Forms after an extended move upwards

- This formation indicates that there will be a reversal in stock market

- We sell when price breaks out below neck-line: see below for explanation.

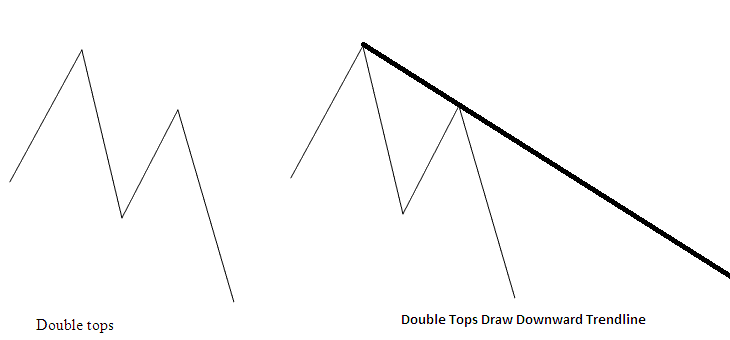

The double top look like an M Shape, the best reversal stock signal is where the second top is lower than the first one as revealed below, this means that the reversal can be confirmed by drawing a down ward stock trend line as shown below. If one opens a sell signal the stop loss will be placed just above this downward trend line.

M-Shaped

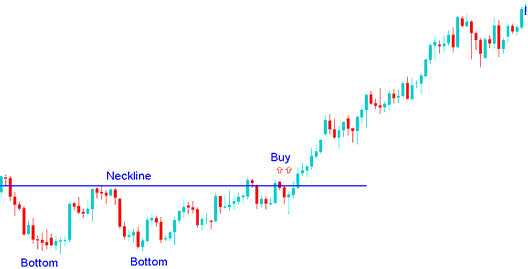

Double Bottom

This is a reversal stock indices setup that forms after an extended downwards trend. It is made up of 2 consecutive troughs that are roughly equal, with a moderate peak between.

This formation is considered complete once price makes the second low & then penetrates the highest point between the lows, called the neck-line. The buy indication from the bottoming out signal forms when the stock market breaks-out the neck-line to the upside.

In Stock Indices, this formation is an early warning trading signal that the bearish trend is about to reverse. It is only considered complete/confirmed once the neck-line is broken. In this formation the neck-line is the resistance level for the price. Once this resistance is broken the stock market will move up.

Summary:

- Forms after an extended move downwards

- This formation indicates that there will be a reversal in stock market

- We buy when price breaks out above the neck line: see below for the explanation.

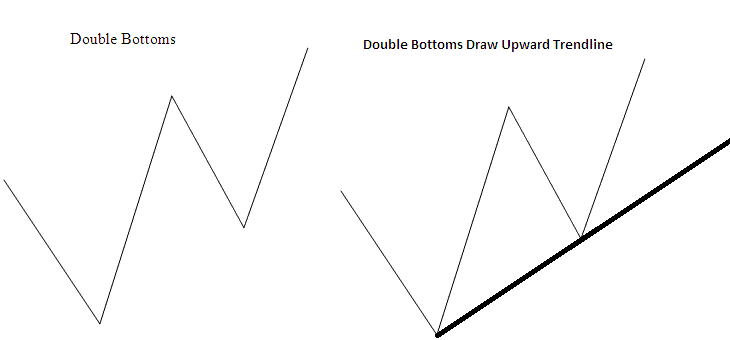

The double bottoms pattern look like a W-Shape, the best reversal stock signal is where the second bottoms is higher than the first one as shown below, this means that the reversal can be confirmed by drawing an upward stock trend line as shown below. If one opens a buy trading signal the stop loss will be placed just below this upwards trend line.

W-Shaped