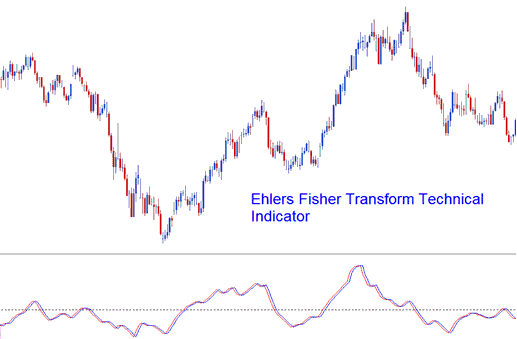

Ehlers Fisher Transform Stock Indices Analysis and Ehlers Fisher Transform Stock Indices Signals

Developed by John Ehlers,

Originally used to trade Stocks and Commodities Market.

Ehlers Fisher Transform has two lines, the Fisher Transform line and the trading signal line: signals are generated when there is a cross-over of these 2 lines which looks like the stochastic oscillator.

It was designed to define major price reversals using the rapid response time and sharp, distinct turning points making it a leading indicator.

This indices indicator is based on the assumption that prices do not have a Gaussian probability density function (bell shaped curved movement), but that by normalizing price and applying the Fisher Transform you can create a nearly Gaussian probability density function on the lines drawn.

Ehlers Fisher Transform

Stock Indices Analysis and Generating Indices Signals

Trading signals can be generated with pin-point accuracy by using the cross-over points of the Fisher Transform & its signal line.

However, this Ehlers Fisher Transform isn't very accurate, as with all leading indicators, it gives many false trading signals and it is prone to whipsaws, it is therefore recommended to trade it in combination with other technical indicators.