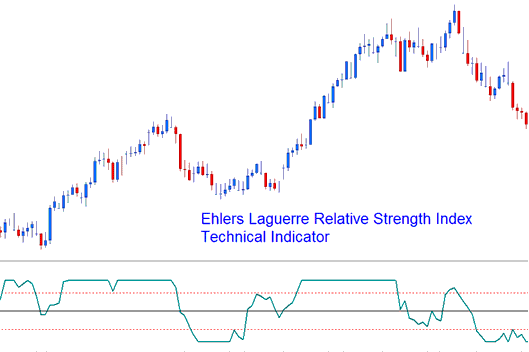

Ehlers Laguerre RSI Stock Indices Analysis and Ehlers RSI Stock Indices Signals

Developed by John Ehlers.

Ehlers RSI uses a 4-Element Laguerre filter to provide a "time distort" such that the low frequency components/ price spikes are delayed much more than the higher frequency components. This indicator enables much smoother filters to be created using short amounts of data.

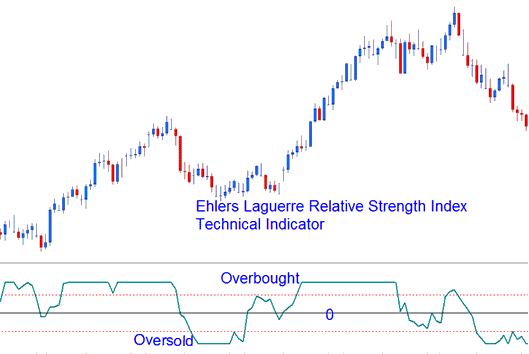

The Ehlers RSI uses a scale of 0- 100, the center line is used to generate stock signals & the 80/20 levels represents overbought-oversold areas.

The only parameter which can be optimized for this indicator is damping gamma factor, usually 0.5 to 0.85, to best suit your trading method.

Ehlers Laguerre RSI

Indices Analysis and How to Generate Trade Signals

This implementation of the Laguerre RSI uses scale of 0-100.

Indices Trading Cross Over Trading Signals

Buy Trading Signal- A buy trading signal is generated when the Ehlers RSI crosses above 50 level Mark.

Sell Signal- A sell trading signal is generated when Ehlers RSI crosses below 50 level Mark.

Overbought/Oversold Levels on Technical Indicator

Overbought/Oversold Levels on Technical Indicator

A typical use of the Laguerre RSI is to buy after it crosses back above the 20% level & sell after it crosses back below the 80% level.