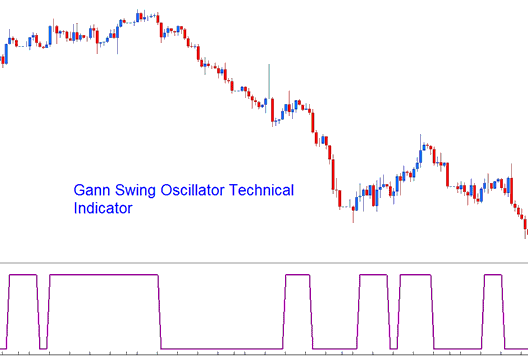

Gann Swing Oscillator Technical Analysis & Gann Swing Oscillator Signals

Developed by Robert Krausz.

This technical indicator is an oscillator & is used to help define market swings.

Swing up - A market swing up is defined by 2 higher highs while a market

Swing low - A market swing low is defined by 2 lower lows.

The oscillator oscillates between values of +1 & -1:

- An up-swing is indicated by a +1 value of the oscillator while

- A down-swing is indicated by a -1 value of the oscillator.

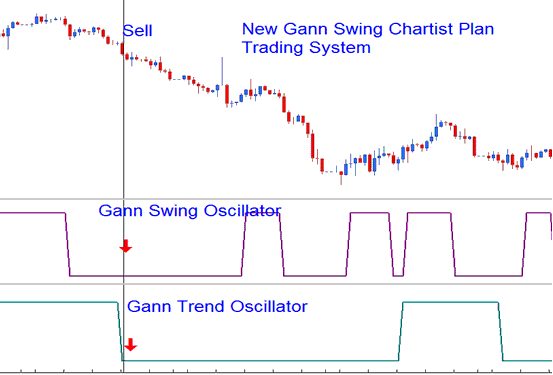

Technical Analysis and How to Generate Signals

Bullish Signal - A buy is generated within a buy trend that is defined by the Gann Trend Oscillator, the buy signal is generated when both these are at the top value.

Bearish Signal - A sell is generated within a sell trend that is defined by the Gann Trend Oscillator, the sell signal is generated when both of these are at the bottom value.

Determine long-term trend

Gann Swing Oscillator - Determine short-term stock trend (Swing/Entry Points).

The Swing Oscillator is meant to be used in combination with the Gann HiLo Activator and Gann Trend indicator to form a stock index system technique commonly referred to as the: 'New Gann Swing Chartist Plan'. Within this methodology the Swing Oscillator is used to help determine market direction for trading only within the current trading market stock trend shown by the Trend indicator.

In the Examples Below the 'New Gann Swing Chartist Plan' stock indices system has been shown. The stock trend (downwards stock trend) is determined by the Trend Oscillator and the entry point decided by the Swing Oscillator.

New Swing Chartist Plan