Keltner Bands Technical Analysis & Keltner Bands Signals

Developed by Chester Keltner. Described in his book 'How to Make Money in Commodities'

Keltner Bands are based on ATR indicator, the bands use ATR values to draw the bands lines.

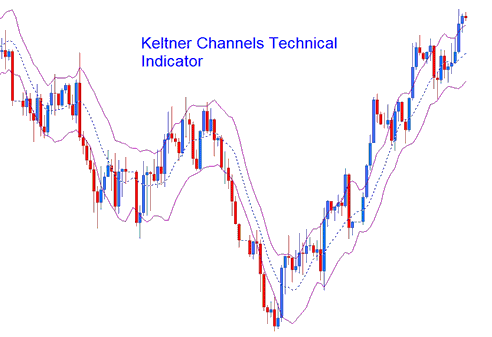

These Bands form Channels which help to identify the market trends using this simple volatility channel.

Keltner Bands

Construction

Keltner Channels are similar to Bollinger Bands except for the fact that Bollinger Bands use standard deviations method to determine market volatility & to draw the bands.

For the keltner bands instead of using the standard deviations the average true range (ATR) measure of volatility is used.

This technical indicator is an n number of periods exponential moving average of the closing price. These bands are created by

Adding (for the upper line) and

Subtracting (for the lower line)

An (n period simple moving average of an n-period ATR) * an ATR multiplier.

Technical Analysis and How to Generate Signals

This technical indicator can be traded in much the same way as a Bollinger Bands.

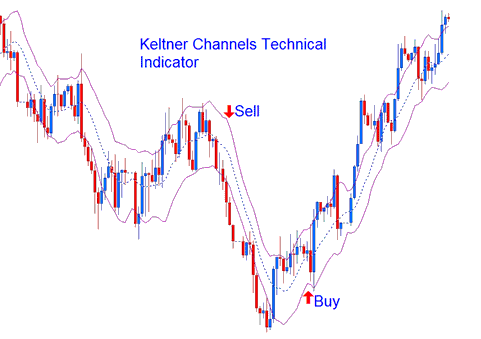

Continuation Trading Signals

When price moves outside the bands then a continuation of the current trend is implied. A buy signal is when the channels are moving upwards and sell signal is when the channels are moving downwards

Continuation Buy Sell Signals

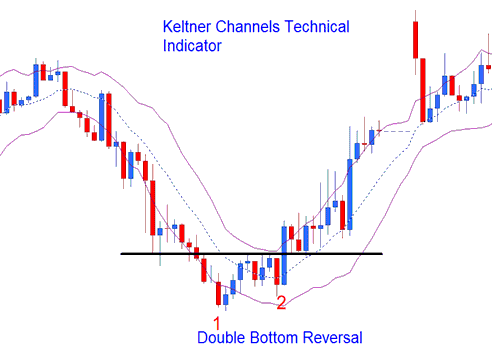

Reversal Signals - Double Tops and Double Bottoms

Tops and Bottoms made outside the bands followed by tops and bottoms made inside the Keltner channels indicate signal for reversals in the trend.

Reversal Signals

Ranging Markets

In range markets a move that originates from one Keltner channel tends to go all the way to the other channel.