MACD Stock Indices Strategies

- MACD Fast Line and Signal Line

- MACD Buy & Sell Signals

- MACD Whipsaws Fake Out Signals

- Generating Centerline Crossover Trade Signals

- MACD Classic Bullish & Bearish Divergence

- MACD Hidden Bullish & Bearish Divergence

- MACD Summary

Bullish & Bearish Signals

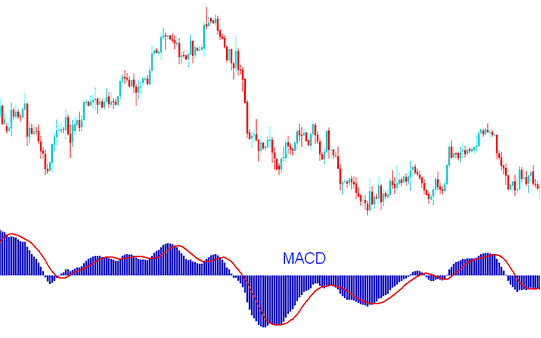

The MACD indicator is one of the most widely and oftenly used technical indicators available. MACD technical indicator is a momentum oscillator with some trend following characteristics.

MACD technical indicator is one of the most popular indicators used in technical analysis. MACD indicator is used to generate signals using cross-overs.

MACD plots the divergence and convergence of moving averages. MACD indicator is constructed using moving average analysis. MA Convergence/Divergence is a trend-following technical indicator. MACD indicator shows the correlation between two moving averages.

One moving average is of a shorter period and the other for a longer period of stock price bars.

MACD Stock Index Indicator - MACD Stock Index Indicator Analysis

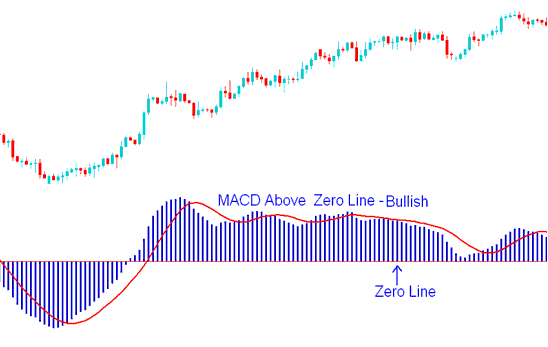

MACD indicator has a zero center line: values above zero line are bullish while those below zero are bearish.

In an upwards trend the shorter MACD line rises faster that the longer MACD line this creates a gap. In addition as long as the MACD indicator is above the center mark the trend is still bullish as shown below.

Do not sell as long as the MACD Indicator is above the Center Mark - this is bullish territory and it does not matter how it is moving as long as it is above the zero center mark, as shown on the example illustrated below.

MACD Indicator Above Zero Mark - Bullish Signal

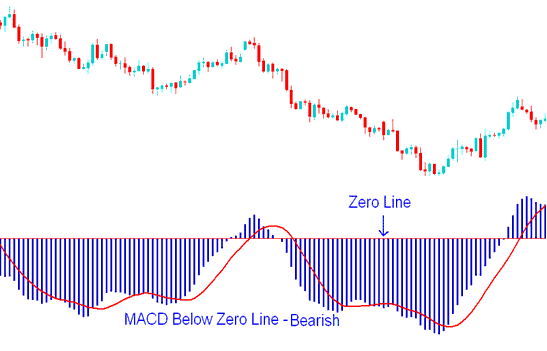

In a downward trend the shorter MACD line falls faster than the longer MACD line this creates a gap. In addition as long as the indicator is below the center mark the trend is still bearish as shown below.

Do not buy as long as the MACD Indicator is below the Center Mark - this is bearish territory and it does not matter how it is moving as long as it is below the zero center mark, as shown on the example illustrated below.

MACD Indicator Below Zero Center Line Mark - Bearish Signal

When the trend is about to reverse the MACD lines start to move closer to each other, thus closing the gap.