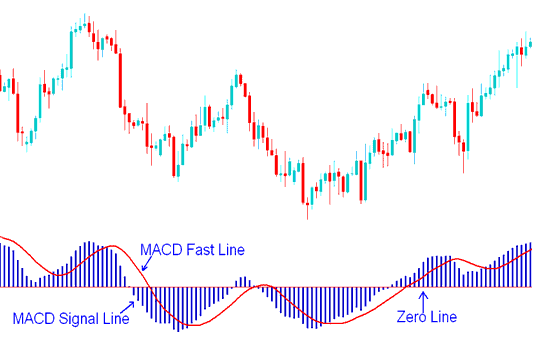

MACD Indicator Oscillator Stock Indices Analysis Fast Line and Signal Line

MACD indicator is used in various ways to give technical analysis data.

- MACD center line crosses indicate bullish or bearish markets: below zero is bearish, above zero is bullish.

- MACD Crossovers indicate a buy or sell stock trade signal.

- Oscillations can be used to indicate oversold & overbought regions

- Used to look for divergence between price and indicator.

Construction of MACD Indicator

The MACD indicator is constructed using two exponential moving averages and this technical indicator plots two lines. The two default exponential moving averages used are 12 and 26. Then a smoothing factor of 9 is also applied when drawing the MACD stock trading technical indicator.

Summary of how MACD indicator is drawn

MACD uses 2 EMAs + a smoothing factor (12, 26 Exponential Moving Averages & 9 smoothing periods)

MACD technical indicator only plots two lines - the MACD fast line and the MACD signal line

MACD Lines - MACD Fast-Line & MACD SignalLines Signals

- The Fast-Line is the difference between the 26 EMA & 12 EMA

- The Signal Line is the 9 period moving average of the MACD fast line.

Implementation of MACD Indicator

MACD indicator implements the MACD line as a continuous line while the signal line is implemented as a histogram. These 2 MACD LINES are then used to generate signals using the crossover trading strategy method.

There's also the MACD center line which is also referred to as the zero mark & it is a neutral point between buyers & sellers trading the market.

Values above the center-mark are considered bullish signals while those below are bearish stock trade signals.

The MACD indicator being an indicator, oscillates above & below this center-line.