McGinley Dynamic Stock Indices Analysis & McGinley Dynamic Signals

Developed by John McGinley

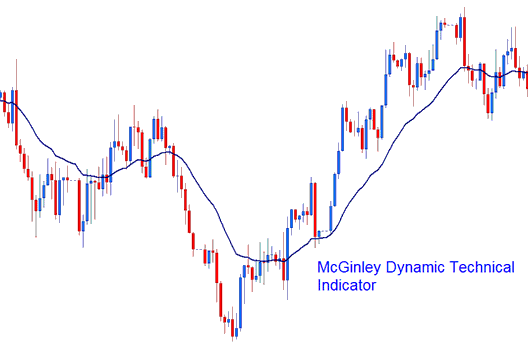

McGinley Dynamic aims to overcome the lag of the traditional simple and exponential moving averages, the indicator automatically adjusting itself relative to the speed of the market. Thus its name, dynamic.

The indicator follows price movements closely in both a fast and a slow moving market.

Indices Analysis & How to Generate Signals

This technical indicator is better at avoiding whip-saws compared to the original moving average.

Calculated using the formula:

Dynamic = D1 + (Indices Price - D1) / (N * (Indices Price/D1)^4)

D1 = previous value of Dynamic technical indicator

N = smoothing factor (of price periods)

^ = Power of

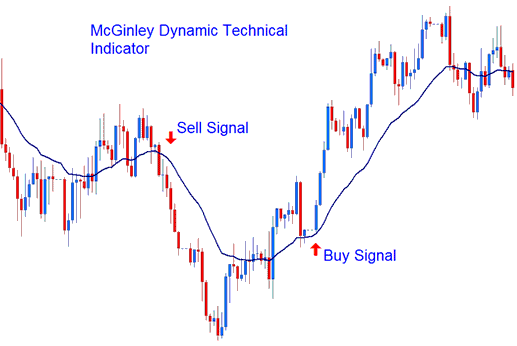

Bullish, Buy Stock Indices Signals and Bearish, Sell Signals

McGinley Dynamic should be combined with moving averages to form a stock index system. McGinley Dynamic should be used as the smoothing mechanisms where the moving average is choppy or ranging.

- Bullish, Buy Stock Indices Signal - A buy signal is generated when price crosses above the indicator.

- Bearish, Sell Signal - A sell signal is generated when price crosses below the indicator.

Technical Analysis in Indices Trading