Stock Indices Trading Moving Average System Explained

Stock Indices Trading 20 Pips Moving Average Stock Indices Systems

The 20 pips price range moving average stock indices strategy is used with the 1 Hour chart and 15 minute chart. On this stock chart time frames we use the 100 and 200 simple moving average technical indicator.

Both the 1 Hour and 15 minute chart time frames will use the 100 and 200 SMA (SMA Indicator) to determine the direction of the Stock Indices trend.

The 1 Hour chart time-frame checks the long-term direction of the Stock Indices trend, upward or downward trend, depending on the direction of the moving averages. All stock trades taken should be in this stock trend direction.

We then use the 15 min chart to find the optimal point to enter stock trades. Indices trades are opened only when the price is within 20 pips range of the 200 simple MA, if price is not within this pip range stock trades are not opened.

Stock Indices Trading Uptrend/Bullish Market

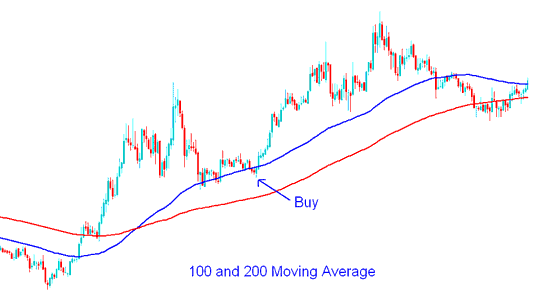

To generate buy (bullish signals) using the 20 pips moving average Stock Indices Trading strategy, we shall use the 1hour and 15 minute chart time-frame.

On the 1 hour chart time-frame the price of the chart should be above both the 100 and 200 simple moving average. We then move to a lower chart time frame, the 15 minute chart time frame to generate a stock trade signal.

On 15 minute chart time frame, when price reaches the 20 pips range above the 200 SMA, we open a buy stock trade and place a stop loss 30 pips below the 200 SMA. Stop loss can be adjusted to the amount of Pips that are suitable for your risk but to avoid being stopped out by normal Stock Indices Trading volatility its best to use 30 pips stop loss.

A buy stock trade can also be opened when the price touches the 100 Simple moving average, provided it’s not very far from the 200 SMA. Normally the 100 SMA will be within the 20 pips range of the 200 SMA.

100 and 200 Simple Moving Average Stock Indices Buy Stock Indices Signal - Moving Average Stock Indices Strategy Method

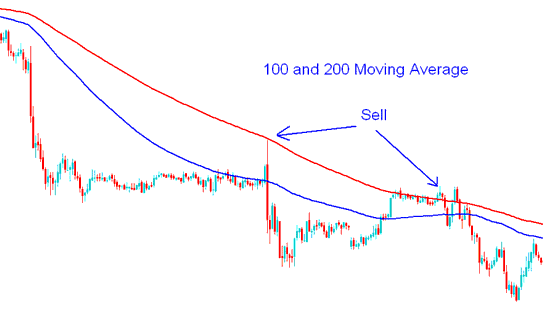

Stock Indices Trading Downtrend/Bearish Market

To generate sell (short signals) using the 20 pips moving average Stock Indices Trading strategy, we shall also use the 1 hour chart time frame and 15 minute chart time-frame.

On the 1 hour chart time frame, the price should be below both the 100 and 200 SMA. We then move to the 15 minute chart time frame to generate a Signal.

On 15 min chart, when price reaches the 20 pips range below the 200 SMA, we open a sell trade and place a stop loss 30 pips above the 200 simple moving average.

100 and 200 Simple Moving Average Stock Indices Sell Signal - Moving Average Stock Indices Strategy Method

With this stock indices strategy method price will generally bounce of these support and resistance levels because many traders watch these levels, and open similar stock trades at around the same point.

These support and resistance levels act as short term resistance or support levels within the price charts.

Profit Taking level for This Stock Indices Strategy

With this stock indices strategy the price will bounce & make a move in direction of the original trend. This move will range from 60 - 70 pips.

The best stock indices profit taking level would therefore be considered to be 60 to 70 pips from the 200 SMA.