MA Whipsaws in Range Markets Stock Indices Strategies

Range Markets Stock Indices Systems

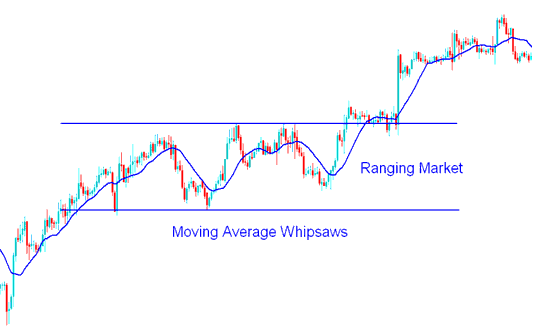

The stock indices moving average is a useful chart indicator to trade with when a trend has formed. However the moving average indicator is prone to whipsaws when the price is trading in range market.

The Moving Average is prone to whipsaws during a ranging market because the price is volatile and keeps moving around the average, causing the stock indices moving average indicator to give signals indicating upward trend and then quickly changing to give sell signals.

It's for this reason that the Moving average indicator should not be used to trade stock indices in a range based market.

Ranging Market and Whipsaws - How to Trade Stock Indices in a Range Market

This is why it is best to combine this stock indices moving average indicator with other indicators when generating signals to trade stock indices with.