Rate of Change Stock Indices Analysis and Rate of Change Signals

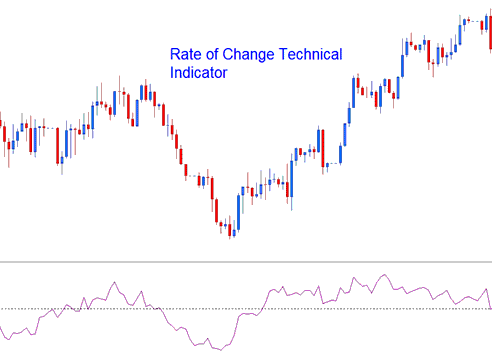

Rate of Change, ROC indicator is used to calculate how much price has changed within a specified number of stock price periods. It calculates the difference between the current candlestick and the price of a chosen number of previous candles.

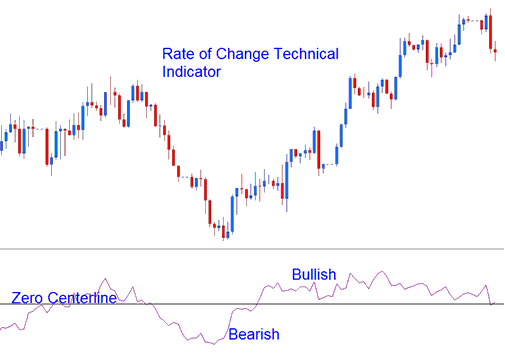

The difference can be calculated using Points or Percents. Rate of Change moves in an oscillation manner, where it oscillates above and below a zero center-line level. Levels above zero are bullish while those below zero center-line level are bearish.

The greater the changes are in the prices the greater the changes in the ROC.

Indices Analysis and How to Generate Trade Signals

Rate of Change indicator can be used to generate trading signals using a number of techniques, the most common ones are:

Indices Trading Cross Over Trade Signals

Bullish Signal - buy trading signal is generated when ROC crosses above zero center line

Bearish Signal - sell signal is generated when Rate of Change crosses below the zero center-line.

Overbought/Oversold Levels:

Overbought - The higher the reading the more overbought a stock indices instrument is. Values that are above the overbought level imply that a price is overbought and there is a pending price correction

Oversold - The lower the reading the more oversold a stock indices instrument is. Values below the oversold level imply that a stock indices instrument is oversold and there is a pending price rally.

However, during strong trending markets the price will remain in the Overbought/Oversold Levels for a long time, and rather than the price reversing the price trend will continue for quite some time. It is therefore best to use the crossover signals as the official buy and sell signals.

Trend Line Breaks

Trend lines can be drawn on ROC indicator just the same way trend lines can be drawn on price charts. Because The Rate of Change is a leading indicator, the trend-lines on the indicator will be broken before those on the price charts. A trendline break on the Rate of Change is an indication of a bullish or bearish reversal trading signal.

- Bearish reversal- Rate of Change readings breaking above a downwards trendline warns of a likely bullish reversal.

- Bearish reversal- Rate of Change readings breaking below an upwards trendline warns of a likely bearish reversal.

Divergence Stock Indices

Rate of Change can be used to trade divergences, and to identify potential trend reversal signals. There are four types of divergences: classic bullish, classic bearish, hidden bullish and hidden bearish divergence.