RSI Indicator Divergence Stock Indices Setups

Stock Indices Trading Divergence is one of the trade setups used by Stock traders. It involves looking at a chart & one more technical indicator. For our example we shall use the RSI technical indicator.

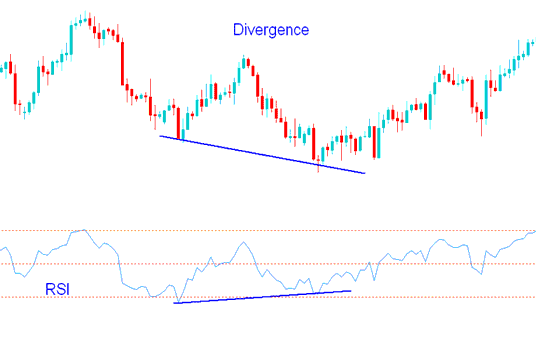

To spot this divergence trading setup find 2 chart points at which stock price makes a new swing high or a new swing low but the RSI indicator does not, indicating a divergence between stock price and momentum.

RSI Divergence Example:

In the stock chart below we identify two chart points, point A and point B (swing highs)

Then using RSI indicator we check the highs made by the stock indices RSI technical indicator, these are the highs that are directly below the Chart points A & B.

We then draw one line on the stock chart & another line on the RSI technical indicator.

RSI Divergence Stock Indices Setup - Stock Indices Trading Divergence Stock Indices using RSI Technical Indicator

How to spot divergence

In order to identify this divergence setup we look for the following:

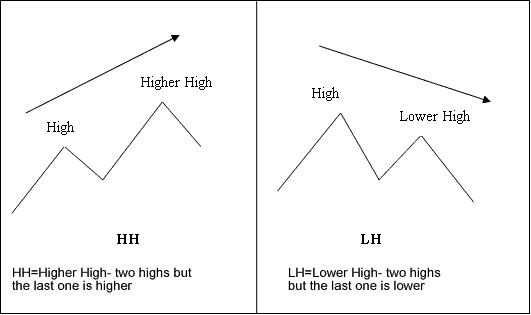

HH=Higher High- 2 highs but the last one is higher

LH= Lower High- two highs but the last one is lower

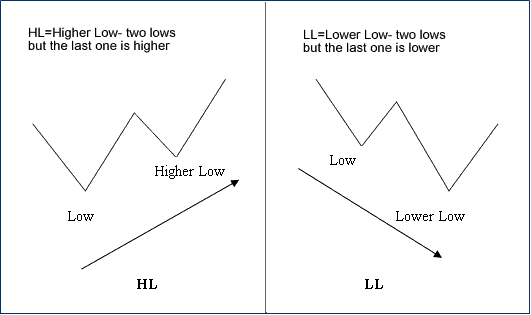

HL=Higher Low- 2 lows but the last one is higher

LL= Lower Low- two lows but the last one is lower

First let us look at the illustrations of these stock indices terms

Divergence Stock Indices Terms Definition

Stock Indices Trading Divergence Stock Indices Terms Definition Examples

There are 2 different types of divergence setups:

- Classic Stock Indices Trading Divergence

- Hidden Indices Trading Divergence