Stochastic Oscillator Indices Strategies

- 3 Types of Stochastic Oscillators

- How Stochastic Oscillator Works

- Oscillator Overbought and Oversold Levels

- Analysis of Stochastic Oscillator

- Stochastic Cross Over Trading Signals

- Stochastic Oscillator Divergence Trade Signals

- Stochastics Stock Indices System

Stochastic Stock Indices Strategy

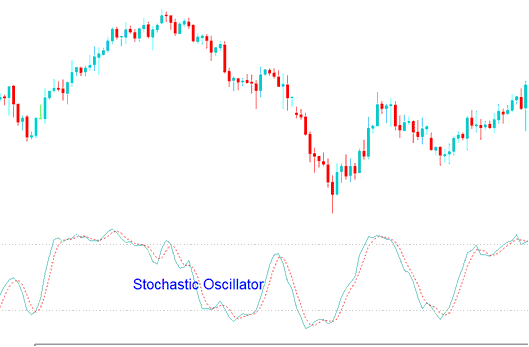

Stochastic Oscillator indicator is an oscillation indicator that measures momentum of a stock indices.

Stochastic Oscillator indicator is based on the idea that in an upward trend price action tends to close at the high of the price candlestick and during a downward trend price action tends to close at the low of the price candle.

Stochastic Oscillator technical indicator shows the strength of the current market trends & it shows regions of oversold and overbought levels.

Stochastic Oscillator indicator is one of the most oftenly used technical indicator, many Stock traders act on stochastic signals hence the signals of this indicator become self predicting.

Stochastic Oscillator indicator is used to identify certain chart patterns, such as divergences.

Stochastic Oscillator indicator can give very early predictions of stock market price activity, thus Stochastic Oscillator indicator is a Leading indicator.

Stochastic Oscillator indicator gives more signals than other main momentum indicators, and these momentum indicators should be used together with other technical indicators.

Stochastic Oscillator indicator is comprised of 2 lines one called the fast line and the other slow line. These 2 lines move in the direction of the trend.

Stochastic Oscillator Indicator - Stochastic Oscillator Stock Indices Method