Stochastic Indicator Overbought & Oversold Levels

Stochastic oscillator stock indicator is used to look for overbought/oversold stock signals. Overbought levels are above 80% level and oversold levels are below 20% level.

Key is to not only look at Stochastic oscillator stock indicator when the %K or %D lines touch or cross overbought/oversold, but also when they cross over and back through these levels.

Just as with other stock indices momentum indicators such as RSI indicator the Stochastic oscillator stock indicator can stay inside the overbought & oversold levels for some time. When this stock indices stochastic oscillator indicator stays within these levels for a long time it indicates strong upward stock trend (overbought) or strong downward stock trend (oversold).

When the stochastic lines cross back below or above these overbought and oversold levels it is usually a good indication of an upcoming stock trend reversal.

A trader can look for further stock signals to make the oversold or overbought levels more reliable if:

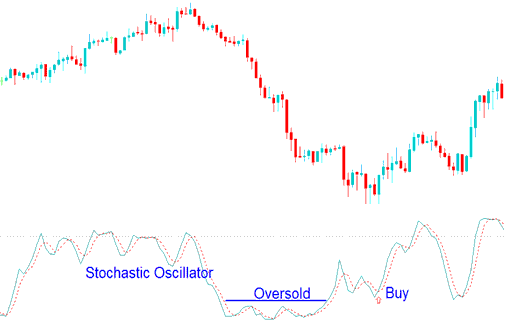

Buy Signal Using Stochastic Oscillator Oversold Levels

- Before Buying, the %K & %D lines turn upwards from below 5%.

- A reading that is floating near 5% means that stock indices bears are in control and there is selling of the stock indices. A trader should wait for the Stochastic Oscillator to move back above 5% as a sign that the selling pressure is easing.

The Buy stock signal is confirmed when the stochastic oscillator stock indicator moves above oversold, then after a while returns to oversold but this time moves up immediately without staying at the overbought.

Buy Signal Using Stochastic Oscillator Oversold Levels

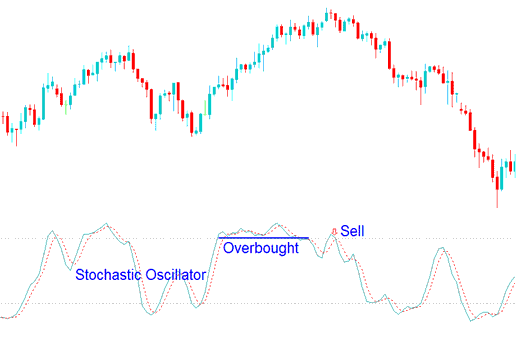

Sell Signal Using Stochastic Oscillator Overbought Levels

- Before Selling, the %K & %D lines turn down from above 95%.

- A reading that is floating above 95% means that stock indices bulls are in control and there is buying of the stock indices. A trader should wait for the Stochastic to move below 95% as a sign that the buying pressure is easing.

- The sell signal is confirmed when the stochastic moves below overbought, then after a while returns to overbought but this times moves downward immediately without staying at the overbought.

Sell Signal Using Stochastic Oscillator Overbought Levels

Looking at different chart time frames when using oversold and overbought levels can also help to determine the correct entry strategy when opening a trade.

The main theory is to trade with the trend. Always double check the stock signals with the longer term stochastic oscillator indicators to confirm stock signals on the shorter stock chart time frame periods.