Written Example Stock Indices Plan Template

Stock index trading plan checklist - the following is a template example of a stock indices plan template example:

JUSTIFICATION

1. Stock Indices Trading IS A BUSINESS, SUCCESSFUL BUSINESSES ALWAYS HAVE PLANS

- Businesses that are successful always start with a plan.

- Successful business planning will guide you to success, think of stock trade plan as a map: it is a constant reminder of how you will consistently pull profits from the market.

- Difference between a successful trader & a losing stock indices one is the stock trade plan.

2. TO KEEP ME IN THE RIGHT DIRECTION when Trading Indices

Consistency is important in your routine to measure how successful you are.

Keep you on target, read the stock trade plan every day & stick to its rules.

When it comes to your trading plan you should think of it as a map which shows you this is what you follow, it should have clear rules that specify when you open or close trade.

Your stock indices plan should cover all aspects of stock indices, you should read the stock indices plan every day until it is on your fingertips so that when you are transacting on the fast moving market of stock indices you will always know what to do in every situation.

Your stock indices plan can be as simple or as complicated as you like, but the most important thing is that you have one. By having a one you have an advantage over the stock market, you will have better chances of making a profit than those who do not have one.

This stock indices plan checklist tutorial topic provides with an example stock indices plan template that you can use for creating your own trade. By now you have already written down the justification part of your stock indices plan template, If not get a pen & paper & write the justification part. Next we shall look at how to write the system.

Stock Indices Trading plan is one of the secrets which can help you to improve your profits. A good stock indices training guide like this one should show you how to come up with one using a stock indices plan template which you can use as an example to develop your own trade plan.

One of the most commonly asked question is, Is Stock Indices Trading profitable? one of the techniques to make it profitable is to have a good plan.

IF YOU HAVE A GOOD Stock Indices Trading PLAN & YOU ARE DISCIPLINED ENOUGH TO STICK TO IT When Indices Trading Stock Indices, YOU WILL BE SUCCESSFUL.

GOALS OF THE TRADING SYSTEM

- Ability to IDENTIFY TREND AS EARLY AS POSSIBLE .

- Ability to AVOID WHIPSAWS .

The stock trade system should find a compromise between the 2 Goals,

Find a way to identify a trend as early as possible but also find ways to help you distinguish the fake trading signals from the live ones.

FUNCTIONS OF EACH INDICATOR

MA - Identify a new trend as early as possible.

MACD - Identify a trend as early as possible.

Determine strength of a continuing trend.

RSI - Swing failure to confirm the start of a new stock index trend.

Extra confirmation tools to help determine the strength of our stock index trend.

Parabolic SAR - Help to ensure that we aren't caught up on the wrong side of the trend.

Stock Indices Trend Lines - Signals a reversal when the line is broken

Indices Price Action Signals - confirm the weakening of a trend.

Bollinger Band - for stock index price action study

To learn more about each indicator & how these indicators can be used to generate trading signal setups you can go to Technical Stock Index Indicators Section

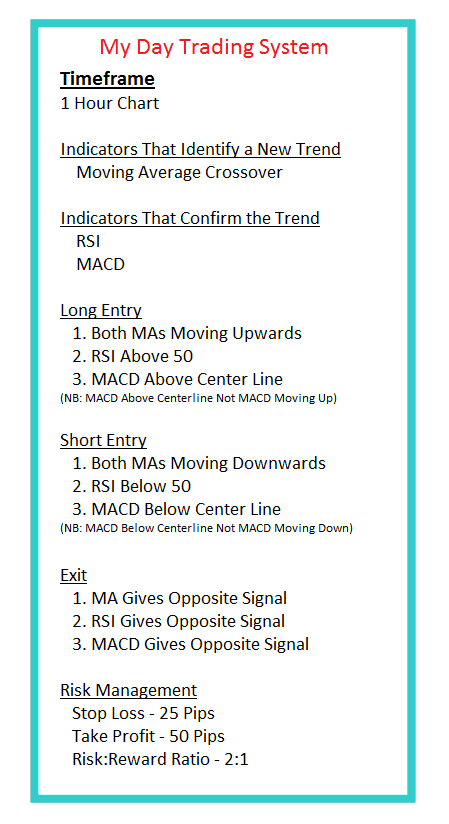

CHART TIMEFRAMES

- Main timeframe is the 1H.

- Signals are generated on 15 minute time frame.

15 Minute Charts

- Stock Indices Trend-Lines (Support & Resistance)

- 5 & 7 LWMA

- RSI (14)

- Bollinger Bands (20, 2)

RULES

LONG ENTRY

Entry

15 Minute Charts

- Both MAs are moving UP

- MACD Above Zero Center Line (Not MACD moving UP)

- RSI >-> 50

- Parabolic SAR is below the price ( Support )

When signal is generated on the 1 Hour Chart, use the 15 minute chart timeframe to open & close positions.

LONG EXIT

- RSI gives opposite signal

- Indices Price breaks Support Trend-Line

- Parabolic SAR is hit (Trailing Stop)

RULES

SHORT ENTRY

Entry

15 Minute Charts

- Both MAs are moving DOWN

- MACD Below Zero Center Line (Not MACD moving Down)

- RSI <-< 50

- Parabolic SAR is above the price ( Support )

When signal is generated on the 1 Hour Chart, use the 15 minute chart time frame to open and close trade transactions.

SHORT EXIT

- RSI gives opposite signal

- Indices Price action breaks Support Trend-Line

- Parabolic SAR is hit (Trailing Stop)

ROUTINE

- Signals are generated using 1H stock chart time frame and executed using the 15 minute chart time frame.

- Trading signal to be executed immediately trading rules are met.

- Entry alert signals should be executed during daytime.

TIME OF DAY TO WATCH MARKET - MARKET HOURS

Watch market during daytime when most companies and online stock brokers are open for trades. Use this to create a suitable program.

Example Trading Plan Template

Tips - You can use the MT4 Stock Indices Software to save this as a stock indices template that way you do not have to lay it afresh every time you open a new chart. If you want to learn how to save a stock indices plan template on the MT4 platform, read: MT4 Stock Indices Platform Tutorial Guides.

Indices Money Management

- Day trading - Low risk High return technique

- Trade when I have a high risk:reward ratio 3:1 or more

- Stop loss = Parabolic SAR

- Set TP target 40-60 Stock Indices Pips

- Never transact beyond 3 % of account equity

- Never risk more than 2% on a single stock trade transaction

Stock Indices Trading MINDSET/PSYCHOLOGY

- Trade without Trading Emotions (greed, fear, impulse, bias, anticipation, overexcitement)

- I trade what I see not what I feel.

- I will be patient.

My job is not to be the stock indices system!

It is not to decide which signal looks promising.

That is the job of my stock indices system - which has a set of stock indices guide-lines which tells me this is what I follow. Don't get caught up in stock index price action and make trading rules as you go along.

MY JOB DESCRIPTION IS

To sit patiently & wait for my stock indices strategy to indicate that it's time to enter or it's time to exit. And then with great focus I execute stock indices plan as outlined.

Taking trades not indicated by the stock indices system, second guessing it and not taking signals given, hesitating and getting in late, anticipating and getting into trades early are all common place and boil down to lack of faith in the plan and not having a burning resolve on accurate trade execution.

GOAL: To have 100 % undivided desire on mastering my ability to execute my Stock Indices Trading rules accurately.

More you cultivate your ability to step back from price movement & watch the stock market dispassionately, waiting for a signal, the easier it will be to witness the fluctuations of your emotions without getting sucked into them and allowing them to throw you off your trading game.

WEAKNESS

- I am greedy.

- I over-trade

- Make a list of all your weaknesses that are interfering with your trading. This is the first step to help you overcome these weaknesses. Use Stock Indices Trading psychology to help you overcome them.

NB: by writing down your weaknesses you will begin recognizing them as you make progress, once you do this you'll start to avoid these trading mistakes and your trading results will improve.

GOALS

- To focus on exit just as much as I do on entry signals.

- Always protect my account using stop loss, stock indices money management techniques, follow with the stock trend direction and always following the trading rules of my trading strategy.

- Never second guess or go against my trading strategy. To always keep up my discipline.

- Follow all the guide-lines of my stock index strategy and never break them.

- Transact fewer times & execute all my signals correctly. Trade what I see, what the system + stock charts are telling me.

- Sit patiently and wait for signals from my strategy.

- Achieve consistent stock indices results before opening a live stock account.

FOLLOW THIS Stock Indices Trading SYSTEM

This is the most important part of creating the stock indices system.

Always follow the trading rules

Stick with the trading rules

Be disciplined & patient enough

Stock Indices JOURNAL

Log all my trades in a stock indices journal so as to track my training progress and improve my stock indices execution trading methods.

This stock indices strategy uses momentum to determine the stock trend of any stock indices.

Even if you're new to stock index trading market and you do not know how a stock indices system looks like, this stock indices system template example illustrates to you how a stock index strategy should look like, the Stock Indices Trading guides described in other sections of this training web site will also explain further the different aspects which you need to learn.

Hence, the objective is to help you create your own complete stock indices strategy that is if you are looking for one, by showing you one that's already complete. In fact you can just use it as it is, or make a few adjustments so that it suits your stock indices style.

The objective is to help you improve your stock indices results by using a stock indices plan, & another advantage is that this stock trade plan will offer you a chance to improve your knowledge and it will help you improve your stock indices results and help you make pips when stock indices and keep them so that you do not keep giving them back to the market.

Read this stock indices plan training lesson about developing a trade plan of your own, along with the learn stock indices courses and trade strategies listed at the tops of this learn stock indices tutorial website.

The Most Beneficial part of using this stock indices plan template is the "Stock Index Money Management Part" you will learn how to trade stock index trading & minimize risk, which is the most important thing when it comes to trading the market.

Stock Indices Plan Checklist - How to Develop a Trading Plan in Stock Indices Trading - Stock Indices Plan Example - Stock Indices Plan Doc