Support and Resistance Stock Indices Technical Analysis and Support and Resistance Stock Indices Signals

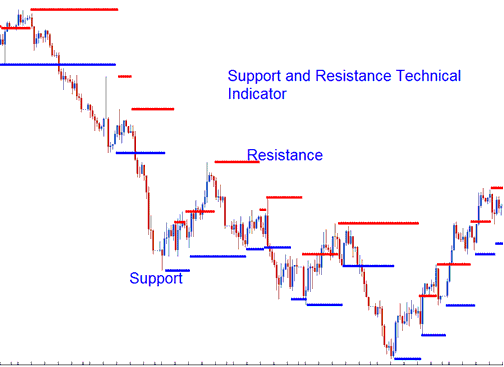

Support and Resistance is one of the widely used concepts in stock index trading. Most traders draw horizontal lines to show these areas.

There is also an indicator used to draw these levels automatically & indicate the resistance and support levels.

When it comes to these levels price can either bounce off these levels or break out through these levels.

If a resistance level is broken stock index price will move higher and the resistance level will turn to a support.

If a support level is broken stock index price will move lower and this level will turn to a resistance.

Indices Price where the majority of investors believe that prices will move higher, while resistance levels indicate the price at which a majority of investors feel stock index prices will move lower.

Once price has broken through a support or a resistance then it is likely that the prices will continue to move in that specific direction until such a time when price gets to the next support or resistance level.

The more often a support or resistance level is tested or is touched by the price and bounces, the more major that particular level becomes.

Indices Technical Analysis and How to Generate Signals

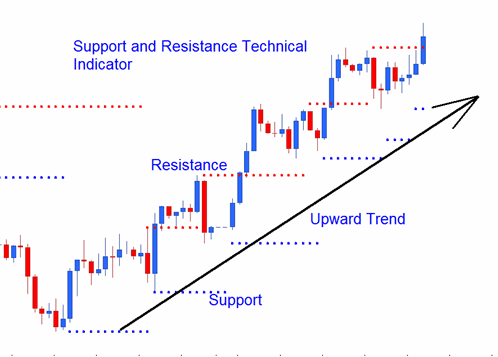

These levels are calculated a trend lines method.

Upwards Indices Trend

In an upwards stock trend the resistance and support will generally head upward

Upwards Indices Trend

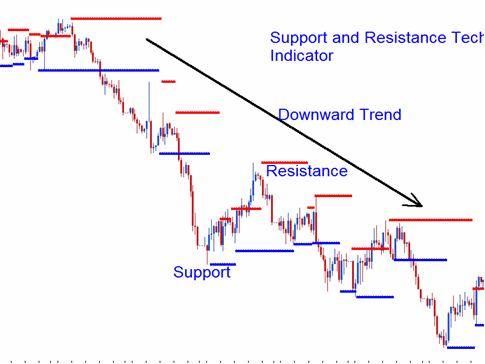

Downwards Stock Indices Trend

In a downwards stock trend the resistance & support will generally head downward

Down-wards Indices Trend