Support and Resistance Levels

This is one of the most widely used concepts in stock index trading and it refers to levels on a chart that tend to act as barriers that prevent the stock price of an asset from getting pushed beyond a certain point in a particular direction.

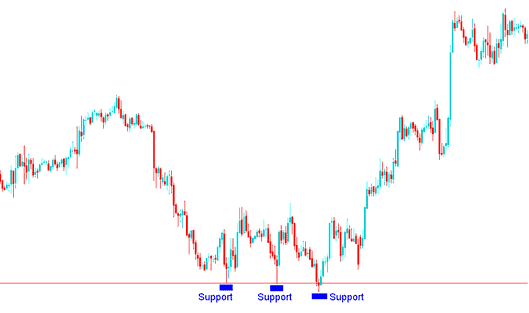

Support

This level prevents the stock price of an asset from getting pushed downwards and therefore it is regarded as the floor because it prevents the market from moving downwards past a certain point.

Example:

On the example illustrated below you can see that stock price moved down until it hit a support

Once stock price hit this level it slightly bounced back up, then resumed going down until it hit the support again.

This process of hitting a level and bouncing back is called testing the support.

The more times a support is tested and the market bounces up the stronger it is - the example illustrated below this level was tested three times without breaking. Finally the market trend reversed and started moving in opposite direction.

Once this level has been decided traders use it to place their orders to buy the at the same time putting a stop loss a few pips below it.

In the example above the market did not move below this area. It is an area where stock price cannot break lower.

These regions form good points where stock price trend in a downward trend is likely to reverse and get support and start moving upwards.

The demand to buy the at this point will be greater & therefore providing a good point to begin a buy trade, while placing stops some pips just below.

This support is also use by short indices sellers as a target where to set their take profit for their short sell stock trades.

This is another reason why the trend is likely to reverse or consolidate at this level because once the sellers close their sell stock trades then momentum of the downward stock trend reduces and a consolidation will happen after which the direction is likely to reverse.

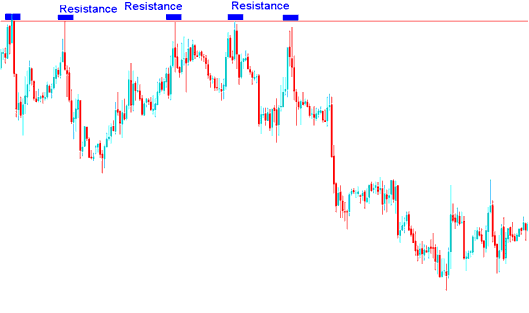

Resistance

This level prevents the stock price of an asset from getting pushed upwards these levels are therefore regarded as the ceiling because these levels prevent the market from moving upwards

Example:

On the example illustrated below you can see that stock price moved up until it hit a resistance.

Once stock price hit this level it retraced slightly the resumed going up until it hit the resistance again.

The resistance holds & is tested five times without breaking.

The more times a resistance area is tested the stronger the it is.

Once this level has been decided traders put their orders to sell at this level and at the same time putting a stop loss a few pips above it.

In the example above the market did not move above this area. This region shows an area where stock price cannot break above.

These levels form good points where a stock price in an upward stock trend is likely to reverse after some resistance and start moving downwards in opposite direction.

This highlights that the demand to sell the at this region will be greater & therefore providing a good point to begin a sell trade, while placing stops some pips just above this level.

This resistance level is also used by buyers as a target where to set their take profit orders for their bullish trades. T

His is another reason why the trend is likely to reverse or consolidate at this level because once the buyers close their sell stock trades then momentum of the upward trend reduces and a consolidation will happen after which the direction is likely to reverse and start moving down.