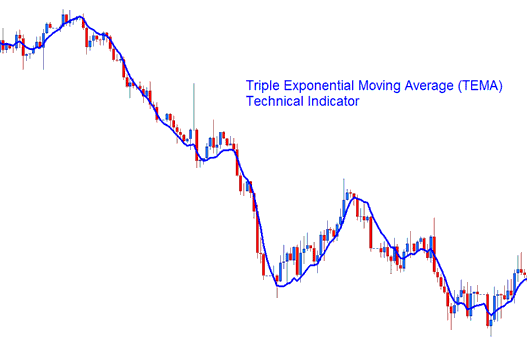

Triple Exponential MA (TEMA) Stock Indices Analysis and TEMA Signals

Developed by Patrick Mulloy.

This indicator was originally used for technical analysis in the Stock exchange and Commodities market before being used in technical analysis.

This a trend following indicator, it was intended to lessen lag of the original exponential moving average.

The calculation is based on three EMAs:

- a single EMA

- a double EMA and

- a triple EMA

The 3 EMAs when combined produce a lesser amount of lag than any of the 3 EMAs.

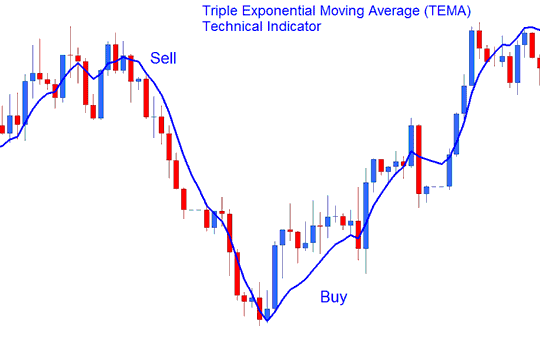

Stock Indices Analysis and How to Generate Trade Signals

The TEMA indicator can be traded in the same way as the original moving averages

The most popular technical analysis technique of generating trading signals is to compare the moving average line and the price action of the stock indices.

- A buy signal is generated when both the price & the indicator are heading upward while

- A sell trading signal is generated when price & the indicator are both heading downwards.

Buy Sell Signal

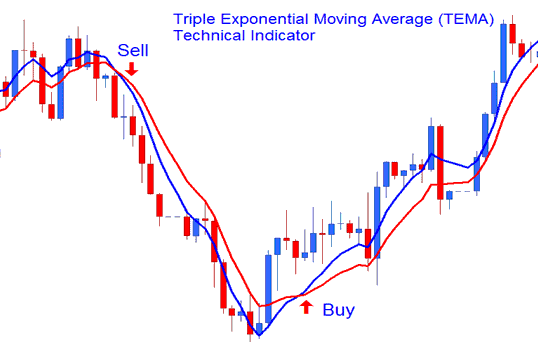

Stock Indices Trading Cross Over Trading System

Another popular technical analysis technique of TEMA is the cross over system.

The TEMA cross-over system includes two or more triple exponential moving averages crossing above/below each other to generate signals. One indicator has fewer periods than the other. This system will also include combining it with other indicators as additional entry confirmation signals

Indices Trading Cross Over Trading System