How to Use Support & Resistance to Trade Stock Indices

In the above previous lesson trades example we have looked at support and resistance levels that were not broken. These points held because they were strong enough.

However, sometimes support & resistances levels aren't strong enough to stop movement of the price moving in a certain direction. When stock price moves past these support and resistance points we say the levels have been broken. That is why we always use a stop loss when trading these levels, just in case they don't hold.

But what happens when these levels are broken, well the levels change one to the other, for example

- When a support is broken it becomes a resistance

- When a resistance is broken it becomes a support

Using charts, the example below show an illustration of what happens when these levels break:

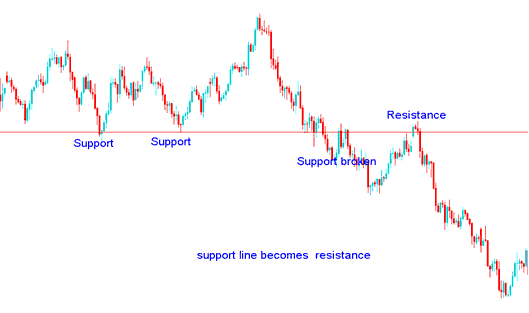

Support is broken it becomes a resistance

In the stock example illustrated below, the support that had been tested two times could not hold the third time, the sellers were able to push the price down past this level.

However, the price bounced back up again, but this time the price could not go up beyond this line. The price was there after quickly pushed down by the sellers. This was because the line that was a support had now turned into a resistance.

In stock index trading when a support is taken out, the stop losses placed below that level are also taken out, thus reducing the momentum that the buyers had. This give sellers an opportunity to short sell the stock index & place their stops just above this level which now turns into a resistance level.

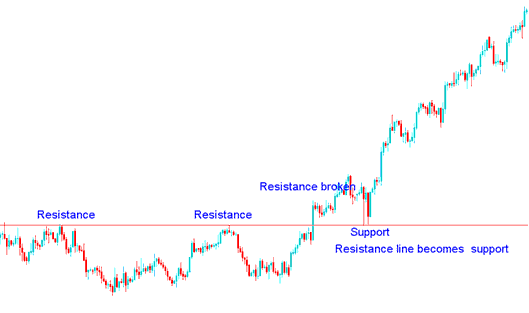

Resistance is broken it becomes a support

In the stock example illustrated below using the chart, the resistance level that had been tested two times could not hold the third time, the bulls were able to push the price up past this level.

When the price tried to go down again it couldn't move lower than this level. The price was there after quickly pushed further upwards by the buyers. This was because the line that was a resistance had now turned into a support. This is what happens in stock index trading, when a resistance level is broken it turn into a support level.

Traders who had closed their short sell stock trades will now open long trades & place their stop losses just below this level.

Major and Minor Resistance Areas

In stock charts the resistance and support levels formed are either major resistance/support points or minor resistance/support points.

Major Resistance/Support levels

In Major Resistance/Support levels price will stay at this level for some time, either the price will consolidate at this point or form a rectangle chart pattern when price gets to this point. This price level will be tested several times before it is either broken or it holds and price doesn't get to move past this support/resistance area.

The above examples are good examples of major Resistance & Support Levels.

Minor Resistance/Support levels

In minor resistance and support points the price will quickly form these points on the trading chart in the short term and quickly move past these resistance and support levels.

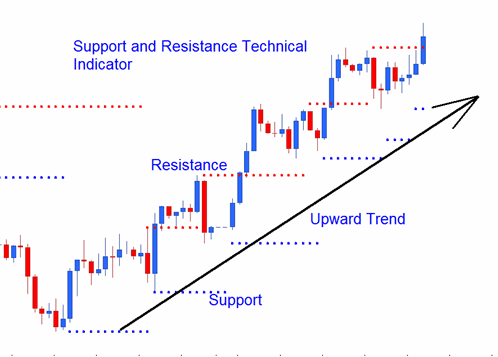

Up-wards Stock Indices Trading Trend: The pattern of this minor resistance and support points will form a series of levels whose general direction is upwards.

Up-wards Stock Indices Trend Series of Support & Resistance

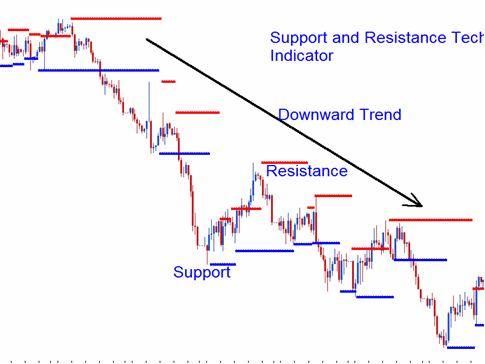

Downwards Indices Trend: The pattern of this minor resistance and support points will form a series of levels whose general direction is downwards.

Downwards Stock Indices Trend Series of Support & Resistance