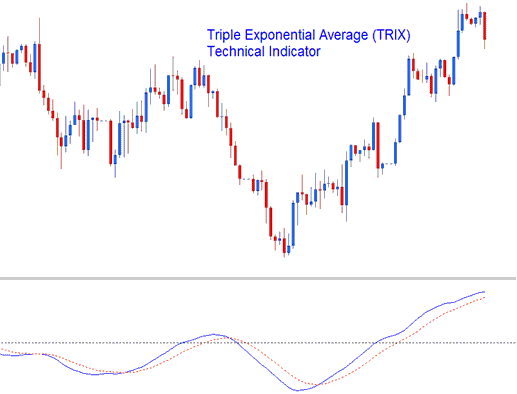

TRIX Stock Indices Analysis & TRIX Signals

Developed by Jack Hutson

TRIX is a triple smoothed oscillator that is designed to eliminate spikes that cause whipsaws in the calculations, these spikes or market cycles that are shorter than the selected indicator period used to calculate and draw are ignored.

TRIX is an oscillator that oscillates above and below a center line mark. The center line level is used to determine bullish and bearish trends. TRIX will measure the momentum of an up trend or a down stock index trend. Above the center-line shows bullish trends & below center-line shows bearish trends

Stock Indices Analysis & How to Generate Signals

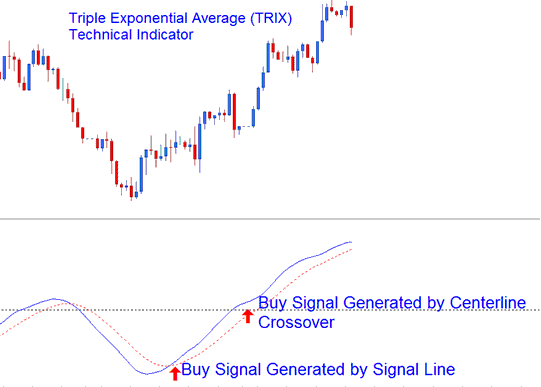

Bullish Buy Stock Indices Signal

A buy signal can be generated using 2 methods:

- The first one is the center-line cross over signal where values above the line are bullish.

- The second one is used to generate a signal when the signal line crosses above TRIX line.

Bullish Buy Indices Signal

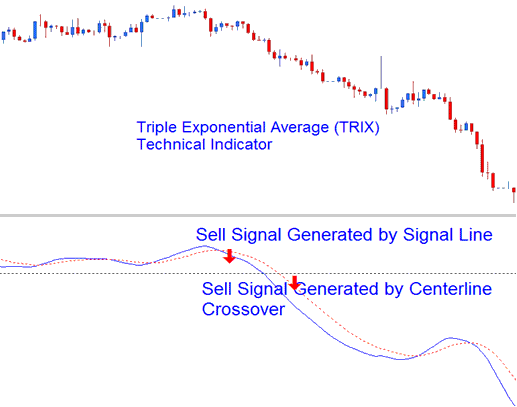

Bearish Sell Stock Indices Signal

A sell signal can be generated using 2 techniques:

- The first one is the center-line cross over signal where values below the line are bearish.

- The second one is used to generate a signal when the signal line crosses below TRIX line.

Bearish Sell Indices Signal

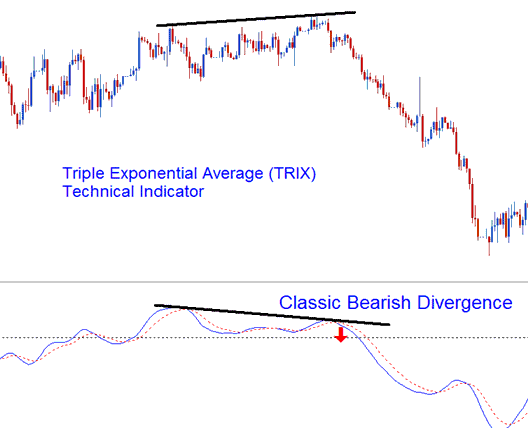

Divergence Stock Indices

Divergence can be used to generate stock signals. Traders can look for divergence between stock index price & the indicator & decide which direction to trade.

Divergence Indices