Dow Jones Industrial Average or Dow 30 - Wall Street 30 Stock Index

Dow Jones Industrial Average or Dow 30 is a market indices that keeps track of 30 of the largest stocks in the USA. The stocks that are used to calculate this component are picked from 30 biggest companies in the USA.

The Dow Jones is the most popular & most followed Stock Indices globally. The Dow Jones Industrial Average originally tracked the performance of Industrial stocks but has changed to include stocks from =the other sectors of the economy. The main criteria being the stocks chosen are from the largest American companies.

The Dow Jones is more volatile than most of the other Top Stock Indices, The Dow Jones although will over longterm trend upwards it will have more price pull-backs & more consolidations than other Indices. Traders may prefer to trade other indices other than the Dow Jones Industrial Average if they are more accustomed to trading more stellar trends found in other top stock indices.

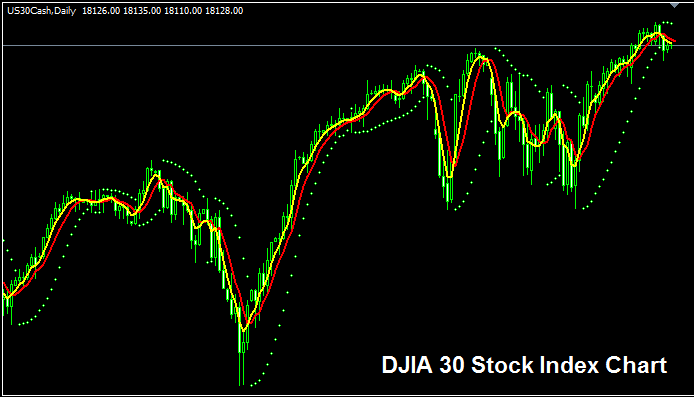

The DowJones30 Stock Index Trade Chart

The DowJones30 Stock Index trade chart is shown and illustrated above. On the above example this instrument is named US 30CASH. As a trader you want to find a broker that provides DowJones30 Stock Index trade chart so that you can start to trade it. The example above is of DowJones30 Stock Index on the MetaTrader 4 Forex & Trading Software.

Other Information about DowJones30 Stock Index

Official Symbol - DJI

The 30 components stocks that makes up DowJones30 Stock Index are picked from the top American companies. The calculation of this stock index is however different compared to other Stock Indices; the price component of the 30 stocks is divided by a common divisor to come up with this stock index. This makes this stock index more volatile than others.

Strategy for Trading DowJones30 Stock Index

DowJones30 Stock Index method of calculating make Dow 30 index more volatile & therefore there are more wide swings in price movement of this stock index. Although this stock index in general moves upward over longterm because the American economy also shows strong growth & is also the largest economy in the world.

As a trader wanting to trade this index, be prepared for wider price swing & a little more volatility.

As a trader you want to be biased and keep buying as the stock index moves upward. When the America economy is doing well (most times it is doing well) this upwards trend is more likely to be ruling. A good trade strategy would be to buy dips.

During Economic SlowDown and Recession

During economic slowdown and recession times, companies begin to report lower profits & lower growth prospect. It is because to this reason that traders begin to sell stocks of companiesthat are reporting lower profits & therefore the Stock Indices tracking these specified stocks will also begin to move downwards.

Therefore, during these times trends are likely to be heading downward & you as a trader should also adjust your strategy accordingly to suit the prevailing downwards trends of the stock index that you are trading.

Contracts & Specifications

Margin Required Per Lot - $ 150

Value per Pips - $ 0.5

NB: Even though general trend is generally upward, as a trader you have to consider & factor in the daily market volatility, on some of the days the Stock Indices might move in a range or even retrace and pullback, market retracement move may also be a significant one at times & therefore as a trader you need to time your trade entry precisely using this trade strategy: Stock Index trading strategy & at same time use proper money management guidelines just in case there is more unexpected volatility in the market trend. About money management methods in indices trading topics: What is Stock Index money management & Stock Indices money management methods.