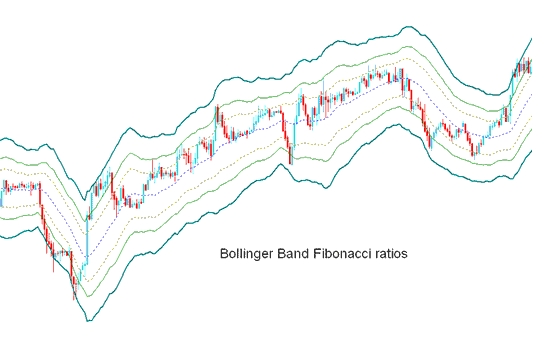

Bollinger Band Indicator

Derived from the original Bollinger bands.

The Bollinger Fibonacci ratios is a volatility based indicators but it does not use the standard deviations to calculate the width of the bands instead it uses a smoothed ATR that are multiplied with Fibo ratios of 1.618, 2.618, and 4.236.

The smoothed lines that are multiplied with Fibo ratios are then added or subtracted from the moving average.

This forms 3 upper Fibonacci bands and Three lower Fibonacci bands

Middle band forms the basis of the market trend.

Stock Technical Analysis & Generating Stocks Signals

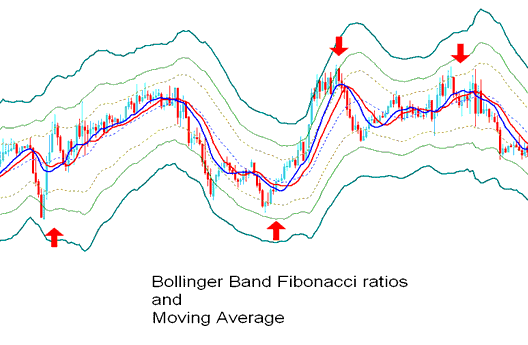

This stocks indicator used to determine point of support and resistance for a stocks.

Lines below represent support points while those above are resistance zones.

The outermost bands provide the strongest resistance/support.

The inner most bands provide least support/resistance.

The innermost band represents Fibonacci 38.20% retracement level

The second band represents Fibonacci 50% retracement level

The outermost band represents Fibonacci 61.80% retracement level

The indicator is used to determine points where stocks price might reverse. (Stocks Price Pullback Levels)

When stocks price hits one of the lines and reverses then an entry or exit trading signal is generated.

However, it is always good to combine the signal with other confirmation indicators such as the moving average to confirm the signal as displayed below.

Technical Analysis in Stock Trading