Chande Dynamic Momentum Index Stocks Analysis & Chande DMI Stocks Signals

Created by Tushar Chandes

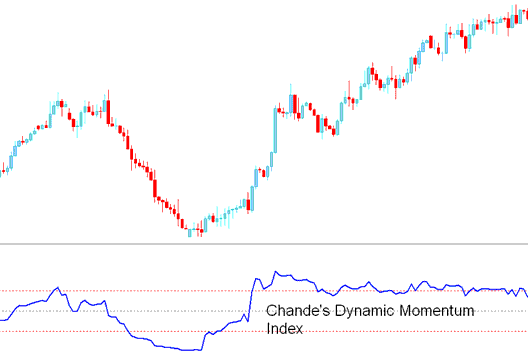

Chande DMI is similar to Welles Wilder’s RSI, however, there is one very important difference.

Relative Strength Index uses a fixed number of stocks price periods while the Chande Momentum Dynamic Index uses a variable amount of stocks price periods as market volatility changes.

The number of stocks price periods used by this Momentum Index trading indicator decreases as the market volatility increases. This allows the indicator to be more responsive to stocks price changes.

The Chande DMI is more accurate than the RSI, has less whipsaws and is less Choppy

Stock Technical Analysis & How to Generate Trade Signals

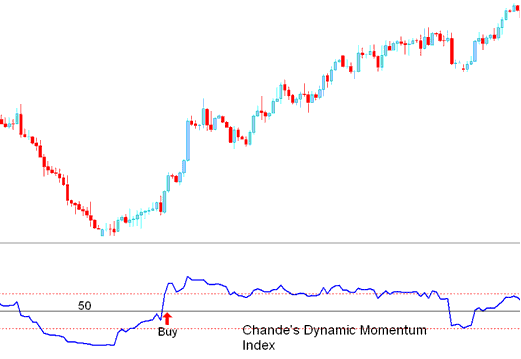

Buy Stocks Signal

A buy signal is generated when the DMI crosses above the 50 level mark.

Buy Stock Signal

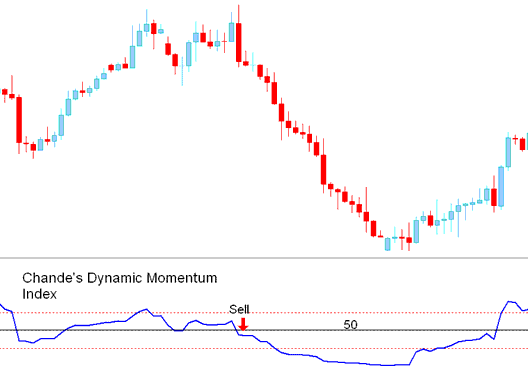

Sell Stock Signal

A sell signal is generated when the DMI crosses below 50 level mark.

Sell Stocks Signal