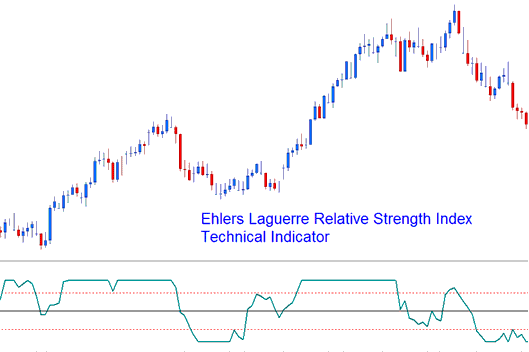

Ehler Laguerre RSI Stocks Analysis & Ehlers RSI Stocks Signals

Developed by John Ehlers.

Ehlers RSI uses a 4-Element Laguerre filter to provide a "time distort" such that the low frequency components/ stocks price spikes are delayed much more than the higher frequency components. This stocks indicator enables much smoother filters to be created using short amounts of data.

The Ehlers RSI uses a scale of 0- 100, the center-line is used to generate stock signals and the 80/20 levels represents overbought-oversold levels.

Only parameter which can be optimized for this technical indicator is damping gamma factor, usually 0.5 to 0.85, to best suit your trading method.

Ehlers Laguerre Relative Strength Index

Stocks Analysis & Generating Stock Signals

This implementation of the Laguerre RSI uses scale of 0-100.

Stocks Trading Crossover Trading Signals

Buy Stocks Signal- A buy signal is generated when Ehlers RSI crosses above the 50 level Mark.

Sell Stock Signal- A sell signal is generated when the Ehlers RSI crosses below the 50 level Mark.

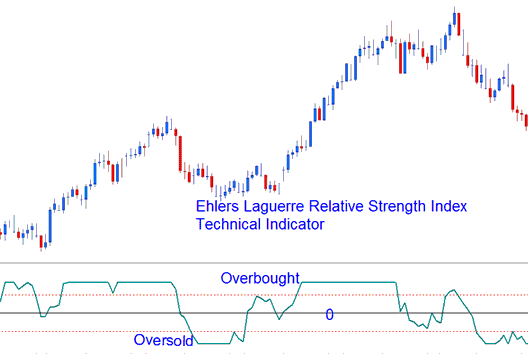

Oversold/Overbought Levels on Technical Indicator

Oversold/Overbought Levels on Indicator

A typical use of the Laguerre RSI is to buy after it crosses back above the 20% level & sell after it crosses back below the 80% level.