MACD Stocks Indicator Oscillator Stocks Analysis Fast Line and Signal Line

MACD Stocks indicator is used in various ways to give analysis data.

- MACD center line crosses indicate bullish or bearish markets: below zero is bearish, above zero is bullish.

- MACD Crossovers indicate a buy or sell stocks trade signal.

- Oscillations can be used to indicate oversold and overbought regions

- Used to look for divergence between stocks price and indicator.

Construction of MACD Indicator

The MACD indicator is constructed using two exponential moving averages and this stock indicator plots two lines. The two default exponential moving averages used are 12 and 26. Then a smoothing factor of 9 is also applied when drawing the MACD indicator.

Summary of how MACD indicator is drawn

MACD uses 2 EMAs + a smoothing factor (12, 26 Exponential Moving Averages & 9 smoothing periods)

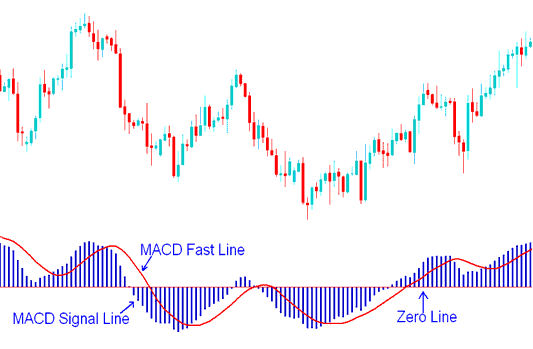

MACD indicator only plots two lines - the MACD fast line and the MACD signal line

MACD Lines - MACD Fast Line & MACD Signal-Lines Stocks Signals

- The Fast-Line is the difference between the 26 EMA and 12 EMA

- The Signal Line is the 9 period moving average of the MACD fast line.

Implementation of MACD Indicator

MACD indicator implements the MACD line as a continuous line while the signal line is implemented as a histogram. These 2 MACD LINES are then used to generate stocks signals using the crossover trading strategy method.

There is also the MACD center-line which is also referred to as zero mark and it is a neutral point between buyers & sellers trading the stocks market.

Values above the center-mark are considered bullish stocks signals while those below are bearish stocks signals.

The MACD indicator being an indicator, oscillates above & below this center-line.