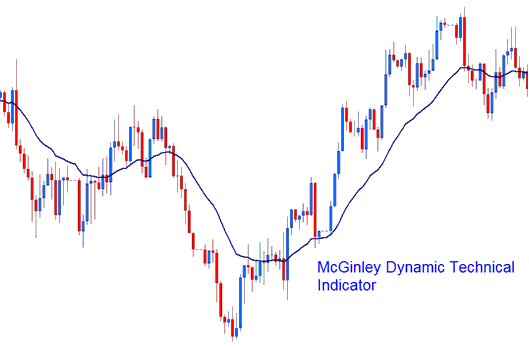

McGinley Dynamic Stocks Analysis & McGinley Dynamic Stocks Signals

Developed by John McGinley

McGinley Dynamic aims to overcome the lag of the traditional simple & exponential moving averages, the indicator automatically adjusting itself relative to the speed of the stock trading market. Thus its name, dynamic.

The indicator follows stocks price movements closely in both a fast and a slow moving stock trading market.

Stocks Analysis & How to Generate Trading Signals

This stocks indicator is better at avoiding whip-saws compared to the original moving average.

Calculated using the formula:

Dynamic = D1 + (Stocks Price - D1) / (N * (Stocks Price/D1)^4)

D1 = previous value of Dynamic indicator

N = smoothing factor (of stocks price periods)

^ = Power of

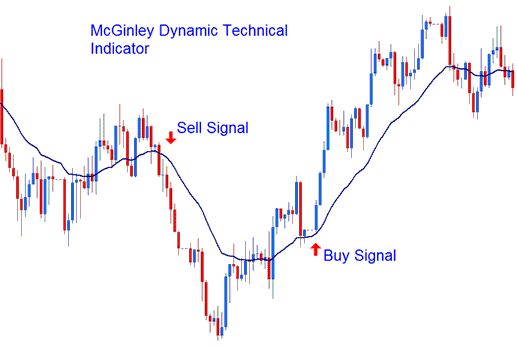

Bullish, Buy Stocks Signals and Bearish, Sell Stocks Signals

McGinley Dynamic should be combined with moving averages to form a stock system. McGinley Dynamic should be used as the smoothing mechanisms where the moving average is choppy or ranging.

- Bullish, Buy Stocks Signal - A buy signal is generated when price crosses above the indicator.

- Bearish, Sell Stocks Signal - A sell signal is generated when price crosses below the indicator.

Analysis in Stocks Trading