Short Term Stocks with Moving Averages

Best Stocks Strategies

Short term stocks will use short stocks price periods such as the 10 and 20 moving average periods.

In the stocks example illustrated and explained below we use 10 and 20 Simple Moving Average to generate Stocks Trading signals: the stocks signals generated are able to identify the stocks trend as early as possible.

Short-term Stocks with Moving Averages - How to Trade Stocks with Moving Averages Example

Scalper Stocks Trader

One of the most widely used method of technical analysis used to analyze stocks chart trends in scalping is the use of moving average indicator.

The idea behind this moving average stocks indicator is to simply enhance analysis before taking a stocks signal to enter the stocks market. Planning and setting stocks goals in the short-term according to moving averages helps a scalper stocks trader to identify trends in the stocks market and thus open a stocks order accordingly.

Most of the stocks signals can be established using a specific stocks price period for the Moving Average Stock Indicator. The stocks Moving averages determines whether the trader will trade in the short-term or long-term. In addition, the stocks price action is above or below this moving average indicator it determines the stocks trend of the stocks market for the day.

If a large part of the stocks market stocks price is considered to be below the Moving average indicator, then bias stocks trend for the day is downwards. Most traders they use the Moving Average as support or resistance to determine where to open a stocks trade position, if stocks price touches the Moving Average Indicator in direction of the stocks market trend a stocks trade is then opened.

The stocks moving averages are drawn and the intersection point with the stocks price can be used to determine the appropriate entry and exit times in the stock market. Since there is always oscillation in the stocks market trends and the stocks market will repeat this process of oscillating and bouncing off the Moving Average, this can be used to generate buy or sell signals.

Simple moving averages are calculated and their approach is based on the observation of the stocks price within a particular period of time using sufficient data to calculate it. Their interpretation has provided many stocks scalpers with lots of tips on how and when to open stocks scalping trading.

Medium Term Stocks Strategy

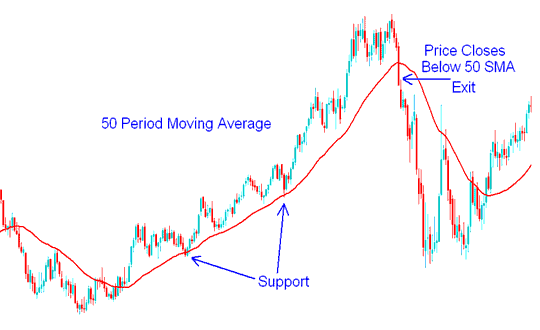

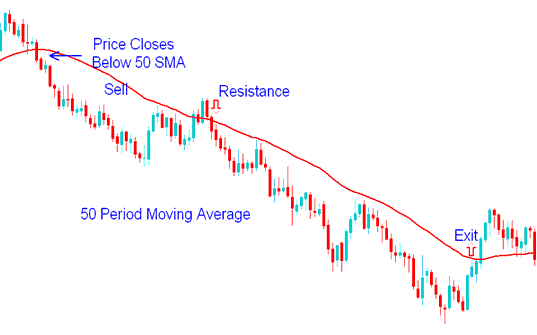

Medium term stocks moving average strategy will use the 50 period Moving Average.

The 50 period Moving Average acts as support or resistance level for the stocks price.

In an upwards stocks trend the 50 period Moving Average will act as a support, stocks price should always bounce back up after touching the Moving Average. If the stocks market closes below the indicator then this will be an exit signal.

50 Moving Average Period Support - Stocks Strategy Method Example

In a down stocks trend the 50 period Moving Average will act as a resistance, stocks price should always go down after touching the moving average. If the stocks market closes above the indicator then this is an exit signal.

50 Moving Average Period Resistance - Stocks Strategies Example

50 Day Moving Average Stocks Analysis

As the stocks trend moves up, there is a key line you want to watch - this is the 50 day stocks moving average. If the stocks market stays above this 50 day stocks moving average, that is a good signal. If the stocks market drops below the 50 day stocks moving average in heavy volume, watch out, there could be stocks trend reversal signal ahead.

A 50 day MA stocks indicator takes 10 weeks of stocks market data, and then plots the average. Moving line is recalculated everyday. This will show the stocks trend - it can be up, down, or sideways.

You normally should only buy when prices are above their 50 day stocks Moving Average. This tells you the current stocks market direction is trending upward. You always want to trade with the stocks trend, and not against it. Many stocks traders only open orders in direction of the trend.

Stocks prices normally will find support over and over again at this 50 day stocks moving average. Big investing institutions watch this level very closely. When these big volume entities spot a stocks trend moving down to its 50 day line, they see it as an opportunity, to add to, or start a new stocks trade position at a reasonable level.

What does it mean if your stocks instrument moves downward and slices through its 50 day line. If it happens on heavy volume, it is a strong stocks signal to sell. This means big institutions are selling their share, and that can cause a dramatic drop, even if fundamentals still look solid. Now, if your stocks instrument drops slightly below the 50 day line on light volume, watch how it acts in the following days, and take appropriate action if necessary.

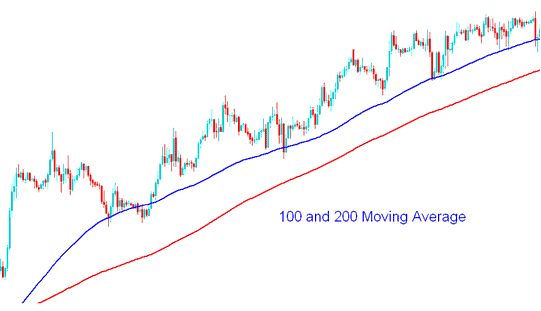

Long Term Trading Stocks Strategy

Long term stocks strategy will use long period such as the 100 and 200 MAs which act as long term support and resistance levels. Since many traders use these 100 and 200 stocks moving averages, the stocks price will often react to these support and resistance areas.

100 and 200 MAs - How to Trade Stocks Using Moving Average Stocks Methods

In Stocks, traders can use both fundamental analysis and technical analysis to help determine whether a stocks instrument is a good buy or sell.

In stocks technical analysis technique stocks traders looking to gauge supply and demand for a stocks instrument use the 200 day moving average to examine data in different ways.

Traders are most familiar with the basic stocks technical analysis of the 200 day Moving Average which is used to draw the long term support or resistance level. If stock market price is above 200 day Moving Average then the trend is bullish, and if it is below it then stocks trend is bearish.

One of the ways to measure supply and demand in stocks is to calculate the average closing stocks price over the last 200 trading sessions. This stock trading moving average accounts for each day going back in time and shows how this 200 day average has moved.

The reason why the average 200 day Moving Average in particular is so popular in stocks technical analysis is because historically has been used and it produces good results for trading in the stock market. A popular timing stocks strategy is used to buy when the stocks market is above its moving average of 200 days and sell when it goes below it.

With this moving average stocks indicator, stock traders can benefit from being notified when a stocks instrument rises above, or falls below its 200 day Moving Average and then traders can then use their technical analysis to help determine if the stocks signal is an opportunity to go long or short.