Pivot Points Stock Technical Analysis & Pivot Points Stocks Signals

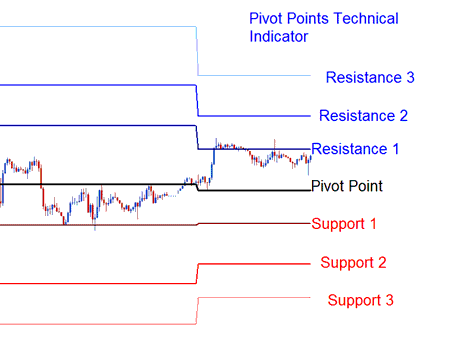

This stocks indicator consists of a central pivot which is surrounded by Three resistance levels below & Three support levels above.

Initially these points were used by floor traders to analyze & trade the equities and futures stocks markets. This stocks technical indicator is considered to be leading rather than lagging.

Pivots provide a quick way for stock traders to analyze the general stocks trend of how the stocks market is going to be moving during the course of the day. A few simple calculations are used to plot the resistance and support levels.

To calculate these points for the coming trading day is the previous day's

- high,

- low, and

- close stocks prices are used

The stock trading day closes at 5:00PM EST this daily market closing time is when the indicator is updated.

The 24-hour cycle for this indicator are calculated using a complex formula. Central pivot is then used to calculate support and resistance levels as follows:

Resistance 3

Resistance 2

Resistance 1

Pivot Point

Support 1

Support 2

Support 3

Stock Technical Analysis & Generating Stocks Signals

This stocks indicator can be used in different ways to generate stock signals. Following techniques are the most common technical analysis:

Stocks Trend Identification Signals

The central pivot is used by traders to determine the general market stocks trend direction. Trades taken will only be in direction of the trend.

- Buy trading signal - price is above central pivot point

- Sell trading signal - price is below central pivot point

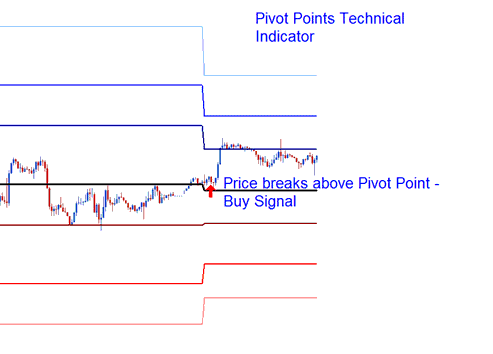

Stocks Price Breakout Signals

Stocks Price breakout signals are generated as follows

- Buy signal - is generated when the price breaks-out upward through the central point.

- Sell signal - is generated when the price breaks-out downwards through the central point.

Stocks Price Break out

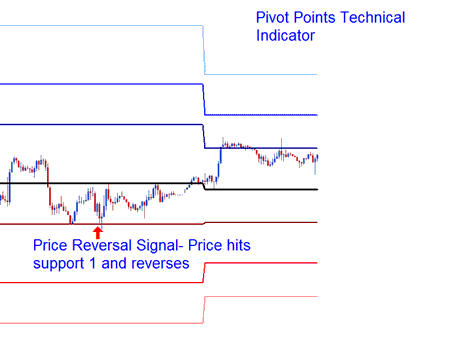

Stocks Price Reversal Stocks Signal

Stocks Price reversals are generated as follows

Buy Stock Signal- when price moves downward towards one of the support area, then touches the support or moves slightly through it then quickly reverses & moves upwards.

Sell Stock Signal- when the price moves upward towards one of the resistance level, then touches resistance or moves just slightly through it then quickly reverses & moves downwards.

Stocks Price Reversal Stocks Signal

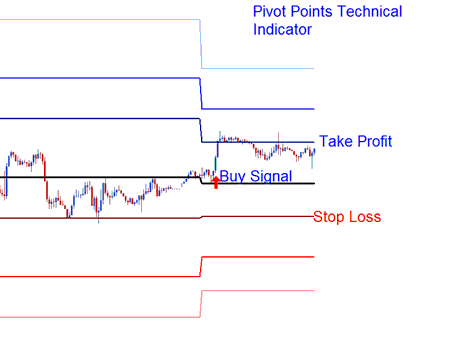

Setting Stop loss and Limit Profit Values

The central pivot and the other support & resistance zones are used by traders to determine suitable stop loss and limit profit levels.

Setting Stop loss and Limit Profit

If a buy is placed above the central point the Resistance 1 or Resistance 2 can be used to set the take profit level, & the Support 1 can be set as a StopLoss Stocks Order Level for the trade.

To download Pivot points technical Indicator:

https://c.mql5.com/21/9/pro4x_pivot_lines.mq4

Once you download it. open it withMQL4 Language Meta-Editor, Then Compile the indicator by pressing the Compile Button Key & it will be added to your MetaTrader 4.

NB: Once you add it to your MT4 Software, the indicator has extra lines referred to as MidPoints, to remove the extra lines open the MQL4 Meta-Editor(shortcut keyboard key - press F4), and change line 16 from:

Extern bool midpivot = true:

To

Extern bool midpivot = false:

Then Press Compile button again, & it will then appear as is exactly shown on this website.